Federal CTC and EITC

The EITC and Minimum Wage Work Together to Reduce Poverty and Raise Incomes

01. 22. 2020

The EITC is a strong policy for boosting low-wage workers’ economic security. Moreover, the minimum wage is an effective complement.

The article originally appeared in the Economic Policy Institute

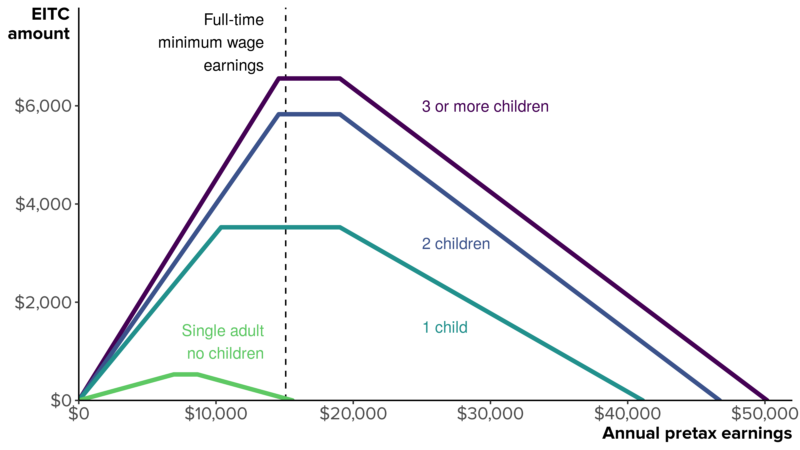

“After decades of rising income inequality and wage stagnation, the problem of inadequate wages for middle- and lower-income workers has only increased in urgency. Discussions of possible remedies have centered on expanding two existing policies: the Earned Income Tax Credit (EITC) and the minimum wage. Both the EITC and the minimum wage have been found to be quite successful at improving the lives of low-income families. The EITC—a refundable tax credit available to low-income families who have income from work—dramatically reduces child poverty, encourages single mothers to participate in the formal economy, and has important positive effects on a range of health, educational, and child developmental outcomes (Nichols and Rothstein 2016; Hoynes and Patel 2018). The minimum wage is more controversial, but the best evidence indicates that it, too, raises incomes and reduces poverty, including child poverty; improves health and public safety; and has little or no negative effect on employment (Dube 2019; Dow et al. 2019; Ruffini 2020; Cengiz et al. 2019).”