Work • Cash Tax Credits

Cash gives people the tools for economic stability and freedom.

Expanding and modernizing the EITC and CTC is a powerful and practical way to help low- and middle-income Americans.

Featured

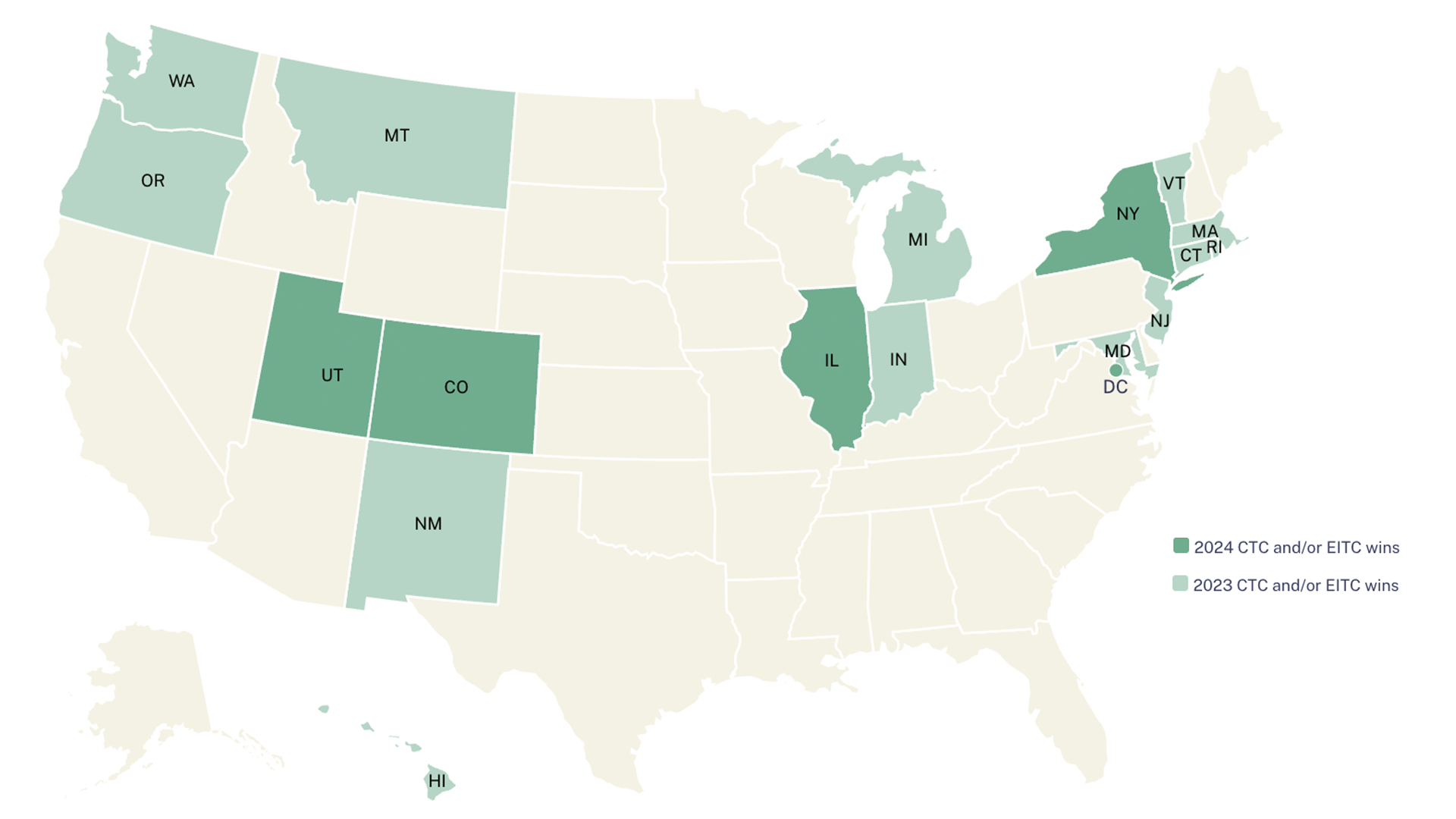

Significant Legislative Wins in Last Two Years for State Tax Credit Programs

The Impact of Direct File—by the Numbers

Read More: The Impact of Direct File—by the NumbersNew program helps L.A. County families claim $500M in unused tax credits

Read More: New program helps L.A. County families claim $500M in unused tax creditsCashing In: Winning Big Bold Tax Credits In States

Read More: Cashing In: Winning Big Bold Tax Credits In StatesCash provides predictability, empowering families not just to make ends meet, but to make choices that aren’t constrained by financial insecurity.

Case in point: the Child Tax Credit. The monthly payments provided in the last half of 2021 took the edge off of everyday worries, like buying groceries and paying the gas bill, while also providing a powerful lever for families to transform their lives. The payments were incredibly effective, resulting in a steep drop in food insecurity among Black and Latinx families in particular.

50%

percentage that child poverty decreased in 2021, in part because of the CTC

82%

of voters support an expanded Child Tax credit.

These credits clearly work, and are popular on both sides of the aisle. Economic Security Project is fighting to expand and modernize cash tax credits, so that they work more powerfully for more people. We aim to make the expanded monthly Child Tax Credit permanent, and to update the Earned Income Tax Credit (EITC). An improved EITC would arrive, like the Child Tax Credit, without the recipient even having to file for it, as an automatic monthly payment, rather than a lump sum at tax time. These monthly cash payments would help smooth income volatility, affording people baseline stability so they can meet their regular expenses and make plans with confidence.

We are also working to ensure these popular credits are easy to receive, and widely and equitably available, regardless of a person’s immigration status or income level. The credits should include low-income students, and those whose work has been overlooked in the past – such as parents or other caregivers caring for young children and those who take care of sick, disabled, or elderly family members.

These goals are ambitious but achievable. Cash tax credits are proven tools that are already at hand. By updating them so they are more effective and accessible to more people, we can build a world where basic financial stability and the freedom it brings are attainable for all.

Campaigns and Projects

Benefits Access and Equity

By design and practice, many of the people who need tax credits the most have the hardest time getting them: research has revealed that a significant proportion of low-income households, including a disproportionate number of people of color, miss out on receiving cash payments through tax credits.

Federal CTC and EITC

We are out in the field, organizing a movement behind this powerful idea, bringing together diverse groups around the country to join the fight for increasing cash benefits for families.

State CTC and EITC

We help build and support state campaigns for cash tax credits headed by changemakers on the ground and give them the resources they need to build powerful coalitions of experts, communicators, organizers, and advocates.