State CTC and EITC

Significant Legislative Wins in Last Two Years for State Tax Credit Programs

09. 05. 2024

Leaders have come together over the last two years to pass pragmatic, bipartisan policies that put more cash in families’ pockets.

The expiration of the expanded federal Child Tax Credit at the end of December 2021 left families struggling to make ends meet. Fortunately, local leaders across the country have come together over the last two years to cross the aisle and pass pragmatic, bipartisan policies that put more cash in families’ pockets to help put food on the table, buy school clothes, pay for childcare, and help parents get to work. State-level tax credit programs advancing across the country can both significantly improve people’s standard of living and ensure they’re weathering rising costs. Many statehouses looked to lessons learned around tax credit implementation from the federal level, adding provisions to ensure benefits are accessible for all families – including children of immigrants – and distributed periodically throughout the year.

The following outlines recent progress to secure Child Tax Credits and Earned Income Tax Credits in states, and summarizes the tremendous impact those policies will have on American families.

Tax Credit Nationwide Trends – By the Numbers

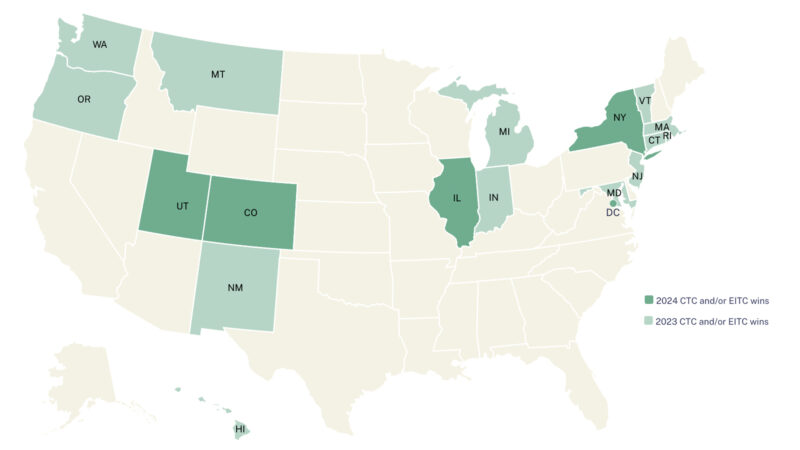

- In 2023 and 2024, 19 states plus D.C. passed 23 new policies that improved, expanded, or created a Child Tax Credit (CTC) or Earned Income Tax Credit (EITC): 18 in 2023 and 5 in 2024.

- $700 more on average was invested in low- and middle-income households per year. This falls short of the $3,600 per-child credit that Congress slashed to $2,000 when they failed to extend the expanded, fully refundable federal Child Tax Credit, but it’s a step in the right direction.

- 4 million households across 19 states and D.C. will receive an additional $3.3 billion in each of the next two years when they file their taxes due to expansions passed in 2023 and 2024 alone.

- In 2021, 8 states had a permanent state-level Child Tax Credit; now, 16 states and the District of Columbia do: AZ, CA, CO, DC, ID, IL, ME, MD, MA, MN, NJ, NM, NY, OK, OR, UT, VT.

23 Tax Credit Legislative Wins in 2023 & 2024

- Colorado (2023)

- Policy: Removes earnings test from the CTC; increases the EITC from a 10% federal match to a 25% match ongoing; increases EITC from 25% to 50% for 2024 only; includes all immigrant residents in both policies

- Credit type: CTC + EITC

- Households impacted: 459,500 (CTC + EITC)

- Credit amount: $200, $600, or $1,200 (CTC) and $150-$1,857 (EITC) – depending on income and filing status

- Additional annual investment in households: $282 million (CTC+EITC)

- Colorado (2024)

- Policy: Increases the state CTC through the new Family Affordability Tax Credit, a credit of up to $3,200 per child under 6, or $2,400 per child 6-16, depending on the state’s economic growth

- Credit type: CTC

- Households impacted: 370,000

- Credit amount: Up to $3,200 per child

- Additional annual investment in households: $684 million

- Connecticut (2023)

- Policy: Increases EITC from 30.5% federal match to a 40% match

- Credit type: EITC

- Households impacted: 211,000

- Credit amount: $240-$2,972

- Additional annual investment in households: $45 million

- District of Columbia (2024)

- Policy: Creates a new permanent CTC for children under 6 in families earning up to $240,000

- Credit type: CTC

- Credit amount: Up to $420 per child

- Additional annual investment in households: $15 million

- Hawaii (2023)

- Policy: Doubles the EITC from a 20% match of the federal EITC to a 40% match

- Credit type: EITC

- Households impacted: 64,400

- Credit amount: $240-$2,972

- Additional annual investment in households: $42 million

- Illinois (2024)

- Policy: Creates a new CTC through an EITC boost for families with children under 11

- Credit type: CTC (through EITC boost)

- Households impacted: 374,000

- Credit amount: 20% of state EIC per household in first year (about $300), 40% of state EIC per household (about $600) in 2025 and beyond

- Additional annual investment in households: $50 million in tax year 2024, $100 million in tax year 2025 and thereafter

- Indiana (2023)

- Policy: Recouples state EITC to federal EITC at a 10% match

- Credit type: EITC

- Households impacted: 539,000

- Credit amount: $60-$743 (EITC)

- Additional annual investment in households: $19 million

- Maine (2023)

- Policy: Makes the state CTC fully refundable

- Credit type: CTC

- Credit amount: $300 per child or other dependent

- Additional annual investment in households: $20 million

- Maryland (2023)

- Policy: Creates a new permanent CTC for young children; increases EITC; both were expanded to include ITIN filers

- Credit type: CTC + EITC

- Children impacted: 440,000 (CTC)

- Credit amount: $500 per child (CTC); up to $560 per adult (EITC)

- Additional annual investment in households: $172 million (EITC + CTC)

- Massachusetts (2023)

- Policy: More than doubles the state’s CTC from $180 to $440, and increases the state’s EITC from a 30% federal match to a 40% match.

- Credit type: CTC + EITC

- Households impacted: 565,000 (CTC); 340,000 (EITC)

- Credit amount: $440 (CTC); $240-$2,972 (EITC)

- Additional annual investment in households: $662 million (CTC + EITC)

- Michigan (2023)

- Policy: Quintuples the EITC from a 6% match of the federal EITC to a 30% match

- Credit type: EITC

- Households impacted: 700,000 (EITC)

- Credit amount: $180-$2,229 (EITC)

- Additional annual investment in households: $384 million (EITC)

- Minnesota (2023)

- Policy: Creates a new CTC of $1,750 for families earning up to $35,000, including ITIN filers; changes EITC to target adult dependents and workers without children in the home; allows state to provide advance payments

- Credit type: CTC + EITC

- Households impacted: Est. 250,000 (CTC)

- Credit amount: $1,750 (CTC); $350 (EITC adults without children)

- Additional annual investment in households: $419 million (EITC + CTC)

- Montana (2023)

- Policy: Increases EITC from 3% federal match to a 10% match

- Credit type: EITC

- Households impacted: 72,000

- Credit amount: $60-$743

- Additional annual investment in households: $11 million

- New Jersey (2023)

- Policy: Doubles the state’s Child Tax Credit from $500 to $1,000 per child age 5 and under

- Credit type: CTC

- Children impacted: 372,000

- Credit amount: $1,000 per child

- Additional annual investment in households: $123 million

- New Mexico (2023)

- Policy: More than triples the CTC; expands eligibility to married people filing separately, a policy change that will support domestic violence survivors

- Credit type: CTC

- Households impacted: 200,000

- Credit amount: $600 per child

- Additional annual investment in households: $103 million

- New York (2023)

- Policy: Expands existing Child Tax Credit to include children under age 4

- Credit type: CTC

- Households impacted: 900,000

- Credit amount: $330 per child

- Additional annual investment in households: $179 million

- New York (2024)

- Policy: One-time increase of CTC of 25% to 100%, depending on income

- Credit type: CTC

- Credit amount: $412-$660

- Additional annual investment in households: $350 million (2024 only)

- Oregon (2023)

- Policy: Creates a new $1,000 refundable credit for children ages 6 and under in low-income families, including ITIN filers; requires state to set up a system for advance quarterly payments

- Credit type: CTC

- Children impacted: 55,000

- Credit amount: $1,000

- Additional annual investment in households: $35 million

- Rhode Island (2023)

- Policy: Increases EITC from a 15% federal match to a 16% match

- Credit type: EITC

- Households impacted: 85,500

- Credit amount: $96-$1,189

- Additional annual investment in households: $2.2 million

- Utah (2023)

- Policy: Creates a new $1,000 Child Tax Credit for children ages 1-3 in low-income households and increases the state’s EITC from a 15% to 20% federal match

- Credit type: CTC + EITC

- Households impacted: 20,900 (CTC)

- Credit amount: Up to $1,000 (CTC)

- Additional annual investment in households: $10 million (CTC)

- Utah (2024)

- Policy: Expands CTC from children ages 1-3 to children ages 1-4

- Credit type: CTC

- Children impacted: 5,600

- Credit amount: Up to $1,000

- Additional annual investment in households: $2 million

- Vermont (2023)

- Policy: Expands CTC and EITC to all immigrant residents; requires state to set up a system for people to receive CTC payments in advance every three months throughout the year

- Credit type: CTC + EITC

- Washington (2023)

- Policy: Expands EITC eligibility to married people filing separately, and provides taxpayers with three years to claim their credits retroactively

- Credit type: EITC

- Households impacted: 6,000 additional taxpayers

- Credit amount: Up to $1,200

- Additional annual investment in households: $3 million