Cash Tax Credits

Get Your Illinois Child Tax Credit in 2026

01. 22. 2026

Messaging to Educate the Public on the Child Tax Credit (CTC) & Earned Income Credit (EIC) in Illinois

Purpose

- This toolkit equips partners with clear, values-driven messaging to educate the public about Illinois’ expanded Child Tax Credit and Earned Income Tax Credit, the advocacy that made these wins possible, and the importance of filing taxes so families can access these benefits.

- Use messaging points in community conversations, media interviews, presentations, and outreach. Use shareable content (graphics, copy) for social media posts and email newsletters.

Call to Action (January 26, 2026)

- On Monday January 26, 2026, tax season opens. Join us for a coordinated day of action to encourage families to file their taxes this year to claim the Child Tax Credit and Earned Income Tax Credit.

- Share information about free or low-cost tax preparation services in your community. Help spread the word so eligible families don’t miss out on money they’ve earned!

- Post using the messages and graphics below, plus send folks to MyTaxIllinois.gov– the State’s site to file Illinois taxes for free.

Main Message Points

- At [YOUR ORGANIZATION], we know that putting cash back into people’s pockets has a real impact on their lives. That’s why we worked to support critical expansions that doubled the Child Tax Credit and expanded the Earned Income Credit in Illinois.

- By bringing together advocates, service providers, researchers, and lawmakers, we helped make the case that these credits are essential for families to afford the basics—like groceries, utility bills, or school supplies.

- The result is a policy that puts real dollars back into the pockets of working families. That’s good for Illinois children, whose long-term outcomes improve when families are more financially stable, and it’s good for local communities, which benefit when tax refunds are spent at small businesses across the state.

- As tax season approaches, it’s also a reminder that these wins only matter if families can access them—which starts with filing a tax return. Implementation and outreach are just as important as passage.

- This year, parents across Illinois will receive a larger Child Tax Credit thanks to Governor Pritzker and a committed group of legislators, advocates, and parents working together in partnership.

- We’ll keep fighting to expand the Child Tax Credit and EITC this year. Make sure you’re getting the money you deserve today. Check your eligibility at MyTaxIllinois.gov

Key Messages

- The Child Tax Credit and Earned Income Tax Credit are proven tools to help families afford everyday necessities like food, utilities, rent, and school supplies.

- These expansions happened because advocates organized, built coalitions, and centered working families.

- Strong families lead to stronger communities and healthier local economies.

- Filing a tax return is the only way families can access these benefits.

On why these credits matter:

- The Child Tax Credit and Earned Income Credit help families afford the basics and reduce financial stress.

- These credits are about dignity. They were designed to reward work and to give children what they need to thrive.

- Right now, as costs continue to rise for just about everything and families budgets are stretched, more credit from CTC can help families afford childcare, housing, groceries.

On advocacy and coalition-building:

- Creating and doubling the Child Tax Credit and expanding the Earned Income Credit didn’t happen overnight. They’re the result of years of sustained advocacy and partnership.

- When advocates, parents, researchers, and lawmakers work together, real change is possible.

On filing taxes:

- These benefits aren’t automatic; families must file a tax return to receive them.

- Make sure to file your return to get the money you’re owed.

- Each year about 20% of eligible families do not claim the EITC or CTC at tax time. This is hundreds of dollars per family, and millions unclaimed across the state.

- Outreach and implementation are just as important as passing the policy.

Shareable Content

Social Media Copy

Sample Social Media Language to Post Along with Graphic

- The Child Tax Credit and Earned Income Credit help Illinois families afford groceries, utilities, and school supplies. These wins only matter if families can access them—see if you’re eligible and file today!

- Advocacy works. Over the past 5 years, Illinois expanded the CTC & EITC to support working families. Eligible families who file can get $$$ to pay for groceries, utilities, school supplies & more. File today!

- [ 1/2 ]

Passing meaningful policy takes sustained advocacy. A strong coalition fought to expand the Child Tax Credit & Earned Income Tax Credit. These put real dollars back into family budgets + strengthen communities statewide.

[ 2/2 ]

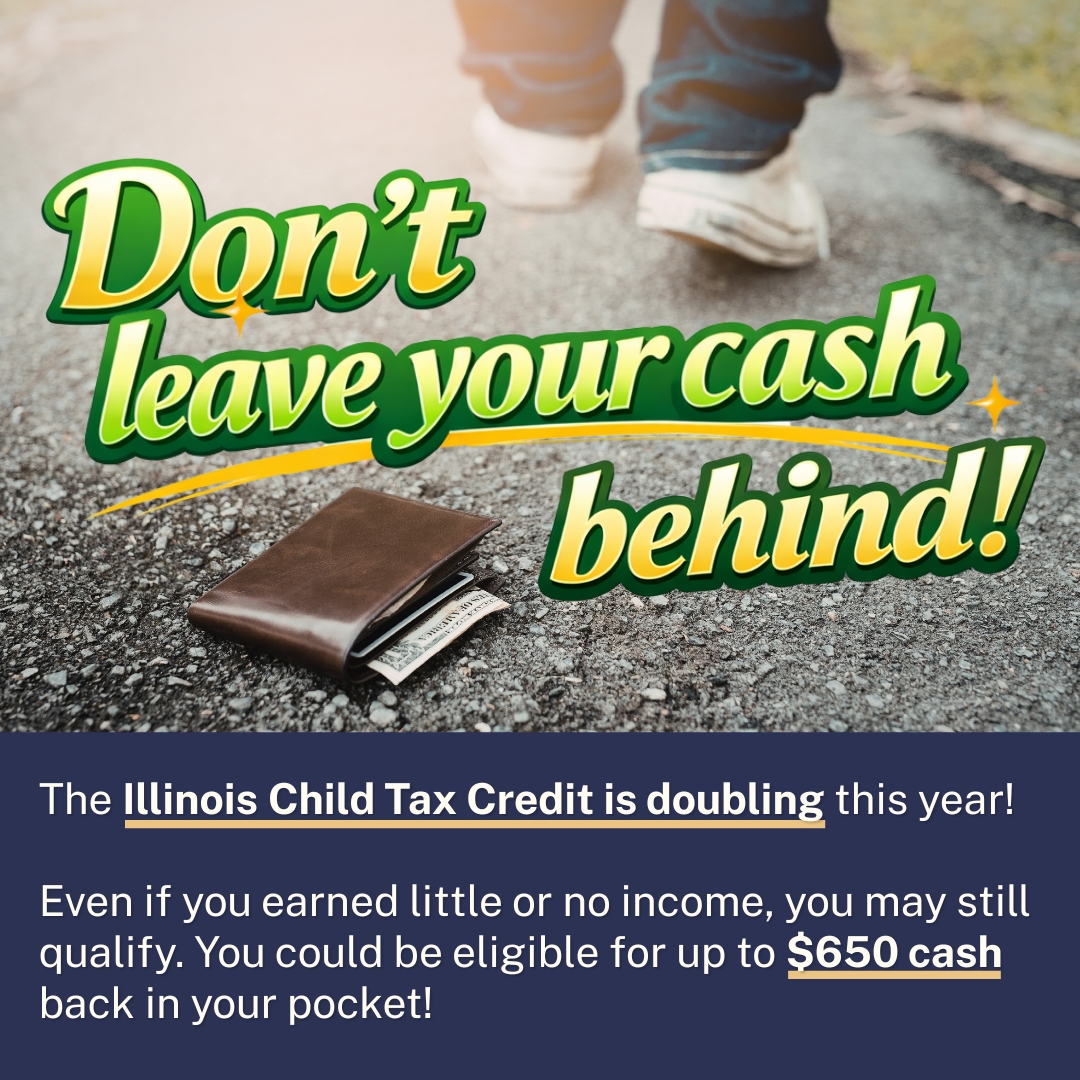

This year, the CTC doubled, offering up to $650. But families only get these credits if they file their taxes. Check if you’re eligible and file your Illinois taxes today MyTaxIllinois.gov - Don’t leave money on the table. The Child Tax Credit is doubling this year, and that means more money for your groceries, rent, or childcare.

- Even if you earned little or no income, you may still qualify. Get started at MyTaxIllinois.gov

- The Child Tax Credit is doubling this year, helping families afford the basics. Those eligible could get up to $650. Filing is the first step. Don’t miss out!

- 📣 Reminder for Illinois families, the Child Tax Credit doubles this year! No tax return = no Child Tax Credit or Earned Income Tax Credit. File your taxes to access the money your family is owed.

Newsletter Blurb

If you’re a worker or parent in Illinois, filing your taxes this year can put hundreds– even up to $650– back in your pocket.

Thanks to legislation passed [legislation I voted for/supported], Illinois has DOUBLED the Child Tax Credit and expanded the Earned Income Credit, making these benefits available to more families. These credits come back to you as cash that can help you cover everyday expenses like groceries, rent, utility bills, childcare, and school supplies.

But there’s an important catch: you must file a return to receive these credits. Even if you earned little or no income last year, you may still qualify, so make sure to file a return!

Free and low-cost tax help is available across Illinois to help families file securely and claim every dollar they’re eligible for. Go to MyTaxIllinois.gov to learn more and start filing today.

This tax season, take a few minutes to file your return and make sure you don’t miss out on the support your family has earned!

Frequently Asked QuestionsFrequently Asked Questions (FAQ)

What are the Child Tax Credit (CTC) and Earned Income Tax Credit (EITC)?

The Child Tax Credit and Earned Income Tax Credit are refundable tax credits that put cash back into the pockets of working families. They are designed to reduce poverty, reward work, and help families afford everyday necessities like food, utilities, rent, childcare, and school supplies.

What changed in Illinois?

Illinois expanded these credits by doubling the Child Tax Credit and expanding eligibility and value of the Earned Income Tax Credit. These improvements mean more families qualify, and many will receive larger refunds than in past years.

Who is eligible for these credits?

Eligibility depends on income, family size, and filing status. Many low- and moderate-income workers and parents qualify—even those who earned relatively little. Families do not need to owe taxes to receive these credits. Learn more about the credit eligibility from the Illinois Department of Revenue here: https://tax.illinois.gov/individuals/credits/child-tax-credit.html

Do families have to file taxes to receive the CTC or EITC?

Yes. Filing a tax return is the only way to claim the Child Tax Credit and Earned Income Tax Credit. These benefits are not automatic, even if a family qualifies.

What if someone earned very little or no income last year?

Many families with low or very low incomes still qualify for refundable tax credits. Filing a tax return is important even if someone is not otherwise required to file.

How do these credits help children and communities?

When families have more financial stability, children experience better long-term outcomes in health, education, and overall well-being. Communities also benefit because tax refunds are often spent locally, supporting small businesses and local economies.

Are these credits only for parents?

The Child Tax Credit is for families with qualifying children. The Earned Income Tax Credit is available to many workers, including some without children, depending on income and age.

Is free or low-cost tax help available?

Yes. Free and low-cost tax preparation services are available across Illinois to help eligible families file accurately and claim the credits they deserve. File your state taxes for free with the Illinois Department of Revenue’s site MyTaxIllinois.gov.

Why is outreach and education so important?

Policy wins only matter if families can access them. Many eligible families miss out simply because they don’t know they qualify or think filing isn’t worth it. Outreach ensures these credits reach the people they were designed to support.

What can advocates do to help?

Advocates can share information about eligibility, encourage families to file their taxes, connect people to free tax help, and spread the message that these credits are a powerful tool for family and economic stability.