Press Release

24 States to Partner With IRS Direct File Next Tax Season, Expanding Free Tax Filing for Millions of Taxpayers

10. 03. 2024

This year’s tool will also be inclusive of more tax situations than in 2024

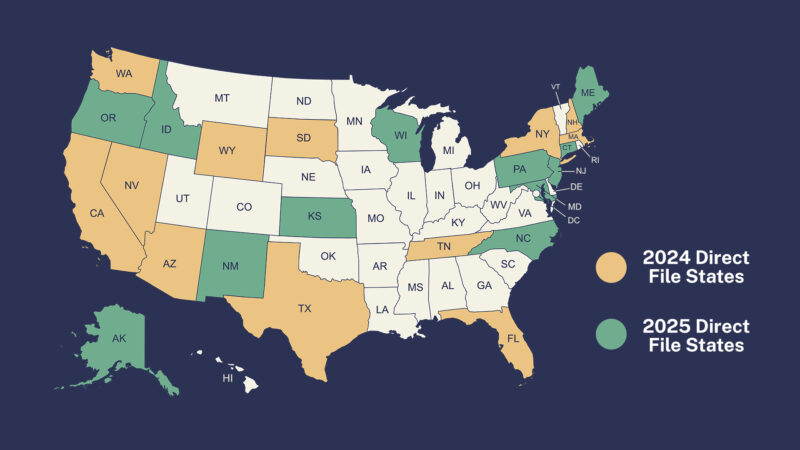

WASHINGTON – The Department of Treasury announced today that 24 states, including Kansas, Alaska, and Idaho, will participate in IRS Direct File as a part of next tax year’s expansion. This significant expansion will allow more than 30 million taxpayers in 24 states to file their taxes for free and access the tax credits that they deserve.

The Coalition for Free and Fair Filing, a group of national, state, and grassroots organizations advocating for a free, IRS-run online tax filing tool, celebrated the announcement as a major win for taxpayers in red and blue states across the country.

IRS Direct File smashed expectations as a pilot program earlier this year, allowing over 140,000 tax filers in 12 states to securely file their taxes for free. Research shows that when the program is made fully available in all 50 states and for various tax situations, IRS Direct File could save taxpayers $11 billion annually just in cost and time savings. Direct File would also meaningfully close the long-standing refundable credits coverage gap by making sure that households can claim up to $12 billion annually in tax credits that are often left on the table because people didn’t file their taxes.

This expansion marks a milestone in taxpayer convenience and efficiency, eliminating the need to depend on tax prep companies in order to file tax returns that should be free and simple.

The states where Direct File is available to taxpayers are: Alaska, Arizona, California, Connecticut, Florida, Idaho, Kansas, Maine, Maryland, Massachusetts, Nevada, New Hampshire, New Jersey, New Mexico, New York, North Carolina, Oregon, Pennsylvania, South Dakota, Tennessee, Texas, Washington, Wisconsin, and Wyoming.

In addition to the tax situations covered last year, this year the tool will also allow taxpayers to claim the Credit for Other Dependents, Child and Dependent Care Credit, Premium Tax Credit, Retirement Savings Contributions Credit, as well as the deduction for Health Savings Accounts. The tool will also support 1099s for interest income greater than $1,500, retirement income, and the 1099 for Alaska residents who receive the Alaska Permanent Fund dividend.

Below are reaction quotes from core members of the Coalition for Free and Fair Filing:

“Through the Direct File pilot, the IRS demonstrated it can provide free, easy tax filing. As more states partner with Direct File, more people will be able to access tax benefits, which will be transformational for American families,” said Aurelle Amram, Senior Director of Growth and Partnerships at Code for America. “Code for America is eager to continue supporting state filing integrated with Direct File via its FileYourStateTaxes program and looks forward to further innovation in simplified tax filing.”

“Direct File has revolutionized the tax filing experience, proving that the IRS can make tax filing simple, easy, and free to American taxpayers,” said Adam Ruben, Vice President of Campaigns and Political Strategy at Economic Security Project. “I applaud the leadership from states eager to build on last season’s success, ensuring millions more taxpayers can access IRS Direct File next year.”

“Today’s announcement marks a significant step toward a future where Americans in every state can file their taxes for free,” said Lindsay Owens, Executive Director of Groundwork Action. “The overwhelming success of Direct File is concrete proof that funding the IRS pays off for taxpayers. It’s absolutely critical that the Agency receives full funding so that thousands more taxpayers can file their taxes securely and for free without needing to rely on predatory for-profit companies.”

“People across the country deserve to be able to break free from having to use expensive corporate products to file their taxes every year and the IRS’s free Direct File online filing software finally created that option for filers,” said Susan Harley, Managing Director of Public Citizen’s Congress Watch division. “It’s very welcome news that additional states are partnering with the IRS to provide a seamless process of free online tax filing. Other state leaders across the country need to quickly step up to the plate to score a similar win for their residents.”

“RESULTS joins its partners in celebrating the expansion of the Direct File program,” said Dr. Joanne Carter, Executive Director of RESULTS. “More households than ever will be able to file their taxes without the burden of predatory fees. As Direct File expands, filers can use this tool to access the tax credits they are owed, putting vital resources in the hands of families battling high food costs, skyrocketing rents, and ongoing economic oppression.”

“State participation is key to making Direct File as beneficial as possible,” said Meg Wiehe, Vice President for State Fiscal Policy & Communications at the Center on Budget and Policy Priorities. “It’s a simple, cost-effective way for states to ensure their residents have access to benefits like the earned income and child tax credits that boost economic security. These credits have the power to cover critical costs such as housing, child care, and other essential expenses, providing substantial financial support for working families who boost our country’s economic health. All states should seize this opportunity to allow all taxpayers to file federal and state taxes easily, directly, and at no cost.”

“We are pleased that New Jersey and New Mexico, Oregon and Pennsylvania, will be integrating the IRS’ Direct File tool in 2025,” said Brandon Tucker, Senior Director of Policy and Government Affairs at Color Of Change. “The Direct File system empowers millions of people to file their taxes simply and directly to the IRS, save time and money, and increase access to tax credits that benefit Black and low-income families. Color Of Change continues to work to encourage other states to join and further eliminate taxpayers’ reliance on predatory corporate tax-prep companies.”

Today’s expansion announcement is also a testament to the leadership and collaboration of state-level organizations who advocated to bring Direct File to their state next year, including the Pennsylvania Policy Center, NC Tax Credit Coalition, The Oregon Center for Public Policy, and more.

“In North Carolina, Direct File is an essential part of modernizing our tax filing system. It is an investment that will immediately help support working families across our state,” said Kate Hanson, co-founder of the NC Tax Credit Coalition. “Direct File is not just an incredible opportunity for families, it is also an opportunity to bring more family advocates into the important work of expanding access to tax credits. If you work to fight hunger, you should be involved in tax credit outreach. If you work in child welfare or education, if you work in the healthcare space, tax credits matter to the work that you do and to the families who you support. Direct File makes it easy to engage in outreach work even if you are not a tax expert. Learning about Direct File, you can become a champion for access to tax credits, and help families learn about and use these new tax filing resources.”

“Pennsylvanians in every corner of our state are eagerly looking forward to taking advantage of Direct File both for federal and state taxes in 2025,” said Marc Steir, Executive Director of the Pennsylvania Policy Center. “Direct File will save Pennsylvania taxpayers in cost and time over $400 million a year.”

If you are interested in speaking further about Direct File with a member of the coalition, please contact Jenna Severson at [email protected] or Manisha Sunil at [email protected].