Update

The House just voted to expand the Child Tax Credit

01. 31. 2024

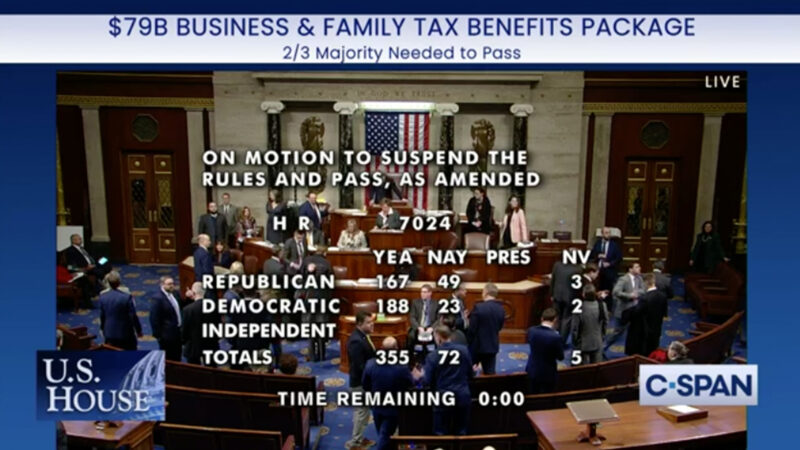

The U.S. House passed a tax bill with a huge 357-vote majority that would expand the Child Tax Credit for 16 million low-income children.

I’m not exaggerating when I say this is a bipartisan win that no one thought was possible and highlights years of effort. Final passage is not a sure thing, but this milestone puts us in a strong position to take this momentum to the Senate and ensure families get the cash they need this tax season.

As you know, many observers doubted our ability to get traction on the Child Tax Credit this Congress. But we doubled down and worked with partners on both sides of the aisle to move this critical policy forward. Here is a quick rundown of what we’ve been doing over the past few months to help make this moment a reality:

- We’ve coordinated efforts through the Cash Working Group and strengthened our collaborations with faith, veteran, and racial justice organizations.

- Maintained a steady communication drumbeat on the popularity of the CTC, including national stories like this NPR piece and frequent mentions in news outlets like Yahoo Finance, Marketwatch, and The Hill.

- Commissioned fresh polling out this week that shows broad and growing public support for the CTC that informed the messaging guidance we shared with policymakers. This latest poll reinforces other polls that show consistently strong support such as Data for Progress, Hart Research, and Lake Research Partners.

- Held strategic meetings with the White House, labor, civil rights organizations, and members of Congress from both sides of the aisle, especially creating connections with local organizations with more conservative members.

- Worked with partners to patch through 5K calls to key Republican members in both the House and Senate.

It’s critical the Senate step up and deliver cash to families immediately. But we need to keep in mind that this bill is a stepping stone for the big 2025 tax fight, and our goal is clear: we need a permanent, monthly expanded Child Tax Credit that is fully available to all low and no-income families and restores eligibility to immigrant children. We must also fight together with our allies to raise taxes on corporations and billionaires.

We’ll achieve this by organizing our progressive base for a CTC that eliminates the income requirement, expanding our bipartisan support, and continuing to broaden the base of support with key constituencies like veterans and faith leaders.