Cash Tax Credits

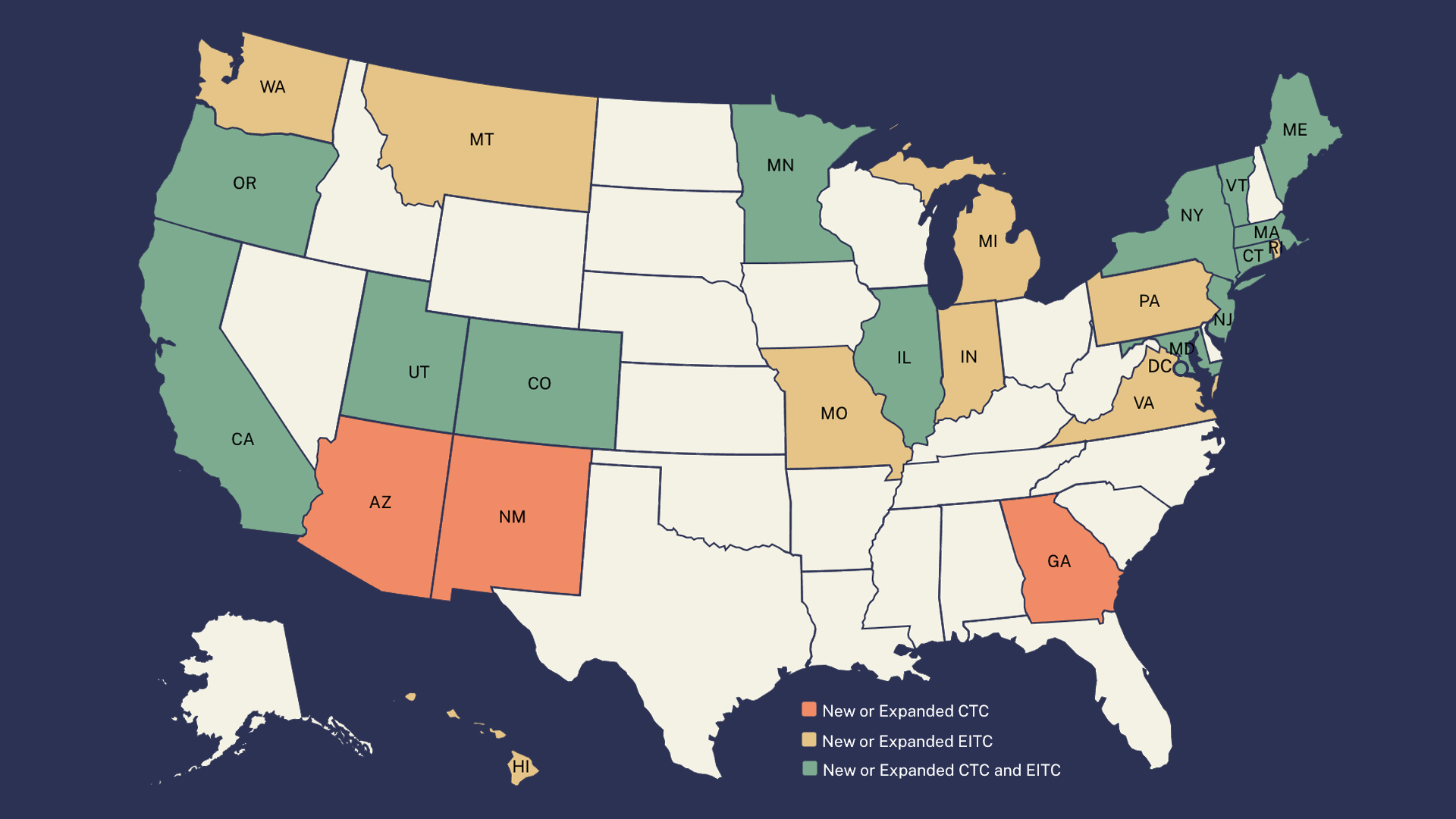

Since the Federal Expanded CTC Expired in 2021, 22 States and DC Have Passed New or Expanded Tax Credits

11. 19. 2025

Tax Credit Nationwide Trends: By the Numbers

- Since the beginning of 2022, 22 states plus D.C. have passed more than 50 new policies that enacted or improved Child Tax Credits (CTC) or Earned Income Tax Credits (EITC), cumulatively putting more than $14 billion in the pockets of Americans over four years.

- Since 2019 when ESP achieved its first tax credit wins, 25 states plus D.C. have passed more than 70 new policies that enacted or improved Child Tax Credits (CTC) or Earned Income Tax Credits (EITC), cumulatively putting more than $24 billion in the pockets of Americans over seven years.

- When Americans file their taxes next year, at least 4 million households will receive $6 billion in cash through targeted state tax credits enacted since 2019.

| Year | Number of states that passed tax credit improvements | Number of policies enacted | Additional annual household benefits |

| 2019 | 4 | 6 | $943M |

| 2020 | 3 | 5 | $142M |

| 2021 | 7 | 9 | $275M |

| 2022 | 12 | 15 | $636M |

| 2023 | 18 | 20 | $2.2B |

| 2024 | 5 | 6 | $801M |

| 2025 | 12 | 14 | $1.5B |

In 2021, only 8 states had a permanent state-level Child Tax Credit. Now, 18 states (including District of Columbia) do: AZ, CA, CO, CT, DC, GA, IL, ME, MD, MA, MN, NJ, NM, NY, OK, OR, UT, VT. (CT and IL CTCs are administered as a bonus on EITC credits for families with children; ID’s CTC will sunset on Jan. 1, 2026.)

Defending Progress on Tax Credits

Many states will face budget crises in the coming year due to the cuts in H.R. 1, the 2025 federal tax bill. Given this context, we will work with state partners to prioritize defensive work across the country so that we don’t lose ground on critical gains we made over the past several years. In a recent survey, half our state partners expressed a medium or high level of concern about the possibility of rollbacks to their state tax credits or delays in implementing expansions. In response, ESP is launching a robust tax credit defense campaign to support state partners that includes:

- A template tax credit defense campaign plan,

- Research & policy backup around credit rollbacks and revenue options,

- Messaging support,

- 1:1 campaign coaching, and

- Grants to state partners.

State Tax Credit Wins in 2025

Connecticut

- Policy: Enacts new Child Tax Credit of $250 per year for EITC recipients with children

- Credit type: CTC

- Households impacted: 80,000

- Additional annual investment in households: $36 million

District of Columbia

- Policy: Enacts new Child Tax Credit of $1,000 per year

- Credit type: CTC

- Additional annual investment in households: $239 million (combined with EITC changes below)

District of Columbia

- Policy: Increases EITC match to 100% of federal

- Credit type: EITC

- Households impacted: 74,000

Georgia

- Policy: Enacts new nonrefundable Child Tax Credit of $250 per child under 6

- Credit type: CTC

- Households impacted: 652,000

- Additional annual investment in households: $141 million

Illinois

- Policy: Budget includes funding to double Child Tax Credit from 20% to 40% of state EITC for families with kids under 12

- Credit type: CTC

- Households impacted: 370,000

- Additional annual investment in households: $100 million

Maine

- Policy: Doubles Dependent Exemption Tax Credit from $300 to $600 for kids under 6 and offsets cost by lowering upper income threshold

- Credit type: CTC

- Additional annual investment in households: $580,000

Maryland

- Policy: Enacts a phase-in for upper-income limit for EITC

- Credit type: EITC

- Households impacted: 15,600

- Additional annual investment in households: $7 million

Montana

- Policy: Doubles state EITC from a 10% to 20% match of federal

- Credit type: EITC

- Households impacted: 71,473

- Additional annual investment in households: $38 million

New York

- Policy: Increases Empire State Credit to $500 per child, or $1,000 per child zero to three

- Credit type: CTC

- Households impacted: 1.6 million

- Additional annual investment in households: $825 million

Pennsylvania

- Policy: Enacts new EITC at 10% match of federal credit

- Credit type: EITC

- Households impacted: 1 million

- Additional annual investment in households: $194 million

Utah

- Policy: Expands CTC from kids 1-4 to kids 1-5

- Credit type: CTC

- Households impacted: 9,600

- Additional annual investment in households: $4 million

Vermont

- Policy: Expands CTC from kids 5 and under to kids 6 and under

- Credit type: CTC

- Additional annual investment in households: $5 million

Vermont

- Policy: Increases EITC for adults without dependents in the home from 38% to 100%

- Credit type: EITC

- Additional annual investment in households: $3 million

Virginia

- Policy: Increases EITC from 10% to 15% federal match

- Credit type: EITC

- Households impacted: 536,000

- Additional annual investment in households: $35 million