In the Media

THE WASHINGTON POST: Activists try to preserve IRS’s Direct File now that Trump has ended it

07. 18. 2025

“It’s no longer a question of ‘Can this be done, and can this be done well? But rather do we want to do it?”

The Washington Post originally published this story.

The Trump administration has shut down the IRS’s two-year-old experiment in free streamlined tax filing, but the people behind Direct File don’t want to let it go quietly.

The massive tax-and-spending law that President Donald Trump signed on July 4 included funds to study a replacement for the IRS-built website that the Republican administration had already begun to dismantle. Yet the idea of keeping the public filingoption alive in some form has brought together a collection of activists and computer programmers including former IRS employees, nonprofit advocates and even an 18-year-old dishwasher in Arizona who wants to create his own tax filing website despite having never filed a return for himself.

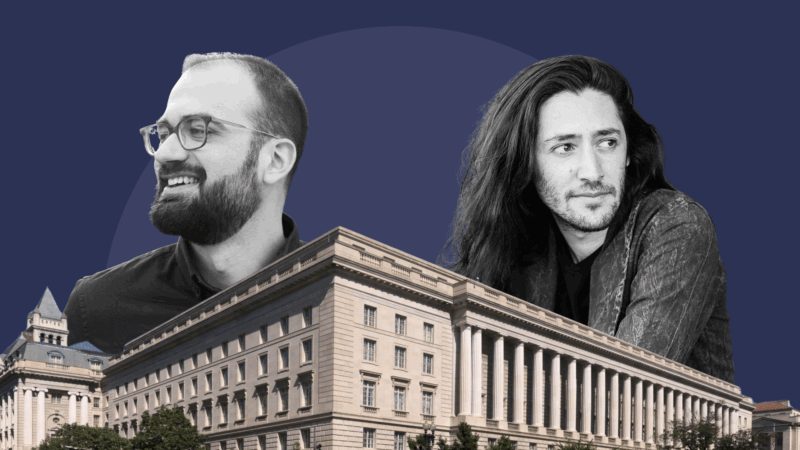

“It’s no longer a question of ‘Can this be done, and can this be done well?’” said Gabriel Zucker, one of four people who have formed a groupat the nonprofit Economic Security Project to keep preparing Direct File for future administrations to use. “It’s just a question of: Do we want to do it?”

Direct File, built by IRS and White House programmers under President Joe Biden, was praised by users for its smooth and easy interface. Available only to people with fairly simple tax returns (no gig workers, for example), the software was offered in 12 states in 2024 and 25 states in 2025. Compared to tax software that people pay to use, Direct File’s uptake was tiny — 140,000 taxpayers in 2024 and, according to a person familiar with the data who spoke on the condition of anonymity to discuss internal Treasury figures, more than 300,000 in 2025. But users generally gave it exceptionally high marks in surveys, and the vast majority said they would recommend it to their friends.

Some of the architects of Direct File hope that the federal government will resurrect it someday.

“I think taxpayers’ appetite for free and simplified tax filing is clearer than ever — and that’s true of Democratic taxpayers and Republican taxpayers,” said Adam Ruben, Economic Security Project’s vice president of campaigns and political strategy. “Direct File is only partisan in marble buildings in Washington.”

Neither the IRS nor the White House responded to messages seeking comment.

The Economic Security Project hired Zucker, who worked with Direct File at the nonprofit Code for America, and three of the top ex-government employees who created Direct File as fellows at the advocacy group. The four of them are working on documentation for the software, and drafting ideas for how to expand and improve it, in the hope that a future administration will pick up where Direct File left off under Biden.

“Let’s get there in the future, rather than give up on the idea that it’s worth it to improve the tax system,” one of the fellows, Chris Given, said in an interview.

The programmers behind Direct File also posted the website’s code online earlier this year, in keeping with a law requiring certain government code to be publicly accessible. Given said that he has been asked about using the code on websites of nongovernment entities, including start-up companies experimenting with AI-based tools that assist accountants, and nonprofits working with states on their tax filing and public benefit websites.

Given said he wouldn’t recommend that someone outside of government simply take the code that his team built and revive Direct File on their own. “The Direct File that we built without the IRS is a bad product,” he said. “You lose all the advantages that you have coming from the IRS,” such asgovernment lawyers reviewing each screen for accuracy and a direct link with the IRS database that can automatically fill information from a taxpayer’s W-2.

Those issues aren’t stopping Elijah Wright. The 18-year-old wants to use the released code as the basis for a workable Direct File website that he would launchthis winter, when he will be a freshman at Arizona State University.

Public projects attract Wright, a mostly self-taught coder. He pointed out vulnerabilities in school district sites to his high school principal. On the open-source platform GitHub, he has offered suggestions in the past for improving an outdated State Department site, and for fixing some typos on the National Weather Service’s site.

Unless Wright completes the process to become an authorized e-filer with the IRS, his site might only be able to generate completed tax forms that a user would then have to print out and mail. He’s also concerned that he can’t afford the necessary server space, which he estimates will cost at least $20 a month.

Still, he’s determined to take the dormant public code and get it up and running. “There should be a much easier way to file your taxes, I think, without giving your data to some company,” Wright said.

Republican lawmakers have criticized the idea of Direct File since its inception, arguing that the federal government shouldn’t create a product that competes with financial service firms and tax-preparation companies, some of which already offer free electronic filing.

In the early months of the Trump administration’s disruption of the federal government under the auspices of the U.S. DOGE Service, almost everyone who worked on Direct File at the IRS resigned rather than be assigned to other projects.

A social media post from then-DOGE leader Elon Musk midway through this tax filing season claimed that the still-operational Direct File website was “deleted.”

Julie Brinn Siegel, a Biden administration appointee who worked on Direct File, called Musk’s post “pretty deliberate sabotage” of the program.

“When one of the most prominent technologists in the country tweets that the site is down or deleted when he could have done the opposite — which is say ‘Most government technology sucks, but check out this great site’ — you see the writing on the wall,” she said.

The new law calls for a $15 million study this summer and fall on ways to replace Direct File. IRS officials will have to produce a report on the cost of “public-private partnerships” to offer free filing for up to 70 percent of taxpayers, as well as an assessment of views “regarding a taxpayer-funded, government-run service or a free service provided by the private sector.”

Critics contend that the language of the bill prejudges the result: an emphasis not on a government-built option but instead on free access to private tax software, akin to the existing Free File program that skeptics say misleads customers into paying for commercial software.

In the 13 states that offered Direct File to their residents for the first time earlier this year, tax season was a mixed bag. Those who tried the software mostly loved it, but few people were willing to use it.

Only about 6,000 Maryland residents tried Direct File, state Comptroller Brooke Lierman said, although the governmentsent an email promoting itto 50,000 taxpayers who had previously filed Maryland taxes using a free, state-operated site.

Users gave the site“overwhelmingly positive feedback,” she said. Maryland officials asked a question about how to improve the site, and one personwrote after filing his taxes, “You cannot improve upon perfection.”

With that kind of positive word of mouth, Lierman predicted “rapid increased uptake in future years if this were to continue.”

In North Carolina, Deputy Secretary of Revenue Angela Altice said the Biden administration had told her that more than 1.6 million North Carolina households would be eligible to use Direct File. Her office put substantial effort into promoting the site, and she was surprised when only about 11,500 taxpayers used it.

“I don’t know that I have an opinion,” she said. “It’s good for the taxpayers — but it does become a question of the cost of the service, and the return on investment.”