Benefits Access and Equity

Let’s make it easier for everyone to get the cash tax credits they are eligible for.

Let’s make it easier for everyone to get the cash tax credits they are eligible for.

Visit resource page: Claim Your Cash Los Angeles: Year One Analysis

Visit resource page: State Tax Credits Exclude Millions of Immigrant Families

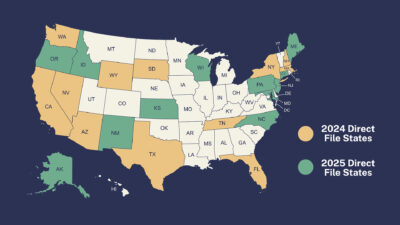

Visit resource page: 24 States to Partner With IRS Direct File Next Tax Season, Expanding Free Tax Filing for Millions of Taxpayers

Visit resource page: The Impact of Direct File—by the Numbers

Visit resource page: New program helps L.A. County families claim $500M in unused tax credits

Visit resource page: How Families of Color Benefit from Free and Simplified Tax Filing

Our goal in this work is to make tax credits more accessible by ultimately shifting the burden of administration away from low-income individuals and families. This includes leveraging data and the power of government to make it simpler for people to get the benefits they’re eligible for.

Challengemillion kids excluded from the full CTC because of income requirements

million kids excluded from CTC because of tax filing requirements

More than 1 in 5 households eligible for the Earned Income Tax Credit – one of our nation’s largest anti-poverty programs – don’t receive it. That’s mostly due to the difficulty people face in filing taxes and claiming the credit.

By design and practice, many of the people who need tax credits the most have the hardest time getting them: research has revealed that a significant proportion of low-income households, including a disproportionate number of people of color, miss out on receiving cash payments through tax credits. This is true for people who are already receiving other government benefits, like food stamps. One major reason for this is that the onus for claiming tax credits, as with other safety net benefits, falls on families and individuals to perform the right combination of tasks at the right time to unlock them – in this case, filing a tax return and claiming the right credits. The act of filing taxes is burdensome, especially for low-income families, immigrants, and people with language barriers. In turn, these families – who are disproportionately Black, Latinx, Native, and immigrant – remain largely unconnected to the tax system, impacting their ability to receive the benefits they are due.

What We DoOur work and that of our partners has pushed the government to make significant strides in reaching more people eligible for cash tax credits, including: paying the Child Tax Credit automatically and in monthly payments to millions of households; offering an online simplified filing option for both stimulus checks and the Child Tax Credit; and offering these tools in Spanish and English and making them more mobile-friendly. States are also exploring innovations in how they distribute tax credits, including finding new ways to share data among agencies to identify eligible households and pay them automatically.