Press Release

Economic Security Project Launches Future of Tax Filing Fellowship to Drive Next-Gen Civic Tech and Benefits Access

05. 28. 2025

New fellows will chart the future of simplified tax filing and help advance the next wave of equitable, people-centered public tech.

Washington, D.C. — Economic Security Project (ESP) announces a new fellowship focused on the future of tax filing, civic tech, and benefits equity. Launching in the wake of the Trump administration’s decision to sunset IRS Direct File—one of the most popular civic tech pilots in recent memory—this new initiative brings together technologists, policy experts, and equity-driven strategists to preserve hard-won progress and accelerate new ideas that make government work better for everyone.

“We’re at an inflection point. People are ready for government that works—and we’ve seen what that can look like,” said Taylor Jo Isenberg, Executive Director of Economic Security Project. “IRS Direct File showed what’s possible when we invest in public infrastructure that puts people first. This fellowship is about building on that momentum to create tangible solutions that meet real needs.”

Direct File earned overwhelmingly positive feedback from users, with 98% reporting satisfaction and a Net Promoter Score of +84. If fully implemented, it was projected to save families up to $23 billion annually in fees, time, and recovered tax credits. In its pilot phase, it helped hundreds of thousands of Americans file their taxes for free—quickly, simply, and without cost. Yet, despite these outcomes, the administration has chosen to shut down the tool—underscoring the need to preserve its legacy and plan what comes next.

The Future of Tax Filing Fellowship will bring together experts with backgrounds in tax policy to preserve Direct File’s legacy and explore new opportunities for public-interest technology that advances equity, accessibility, and impact. They will:

- Document the legacy of Direct File to ensure institutional knowledge isn’t lost, and provide guidance for future initiatives in free and simplified tax filing.

- Design new policy ideas to close the tax credit uptake gap that costs families over $12 billion each year.

- Run a design sprint with Direct File’s original architects to explore new civic tech tools that center equity, accessibility, and trust in government.

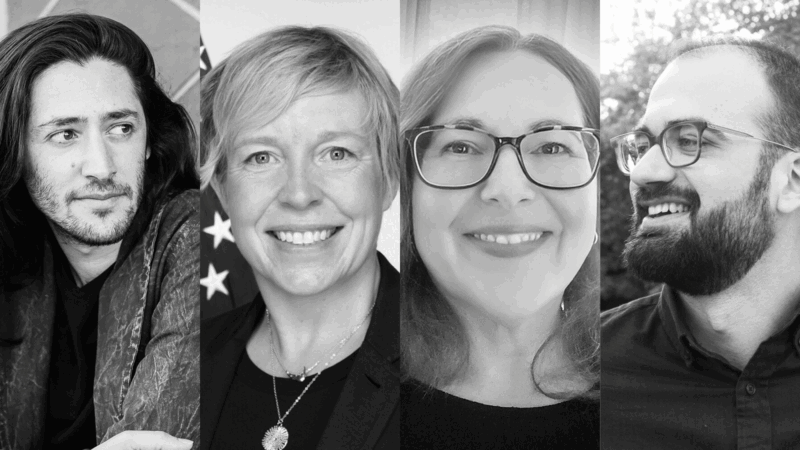

The cohort of fellows includes Chris Given, Jen Thomas, Merici Vinton, and Gabriel Zucker—leaders behind the design, delivery, and defense of IRS Direct File. Together, they bring decades of experience across public-interest technology, human-centered design, tax policy, and benefits access. At ESP, the fellows will document key lessons from Direct File, apply its principles to future-facing public tech, and explore new strategies to expand access to refundable tax credits—especially for those historically underserved by the tax system.

About the Fellows

Chris Given led the team of technologists that built the IRS Direct File, helping more than 450,000 Americans file their taxes for free. A seasoned civil servant, he’s worked across ten federal agencies and three state governments.

Jen Thomas is a design leader with over 15 years of experience improving public services. She led the design of Direct File’s user experience, focusing on clarity and trust for taxpayers.

Merici Vinton is a public sector technologist and former Senior Advisor to the IRS Commissioner. She was a chief architect of Direct File and previously served with the U.S. Digital Service.

Gabriel Zucker co-founded the Coalition for Free and Fair Filing and helped develop FileYourStateTaxes at Code for America. His work spans tax policy, benefits access, and international development.