Free and Simplified Tax Filing

National Taxpayer Survey: Opinion on Direct File vs. Alternatives

04. 25. 2024

New survey reveals high satisfaction and significant time and money savings for tax filers using IRS Direct File

Below is a summary of survey results by David Binder Research. Click to download the full survey.

Summary

David Binder Research conducted a survey of 4,261 adults nationwide who filed a tax return this year. This includes 440 taxpayers who used Direct File, the new federal service that allowed eligible taxpayers in 12 pilot states to prepare and file their tax return for free online this year. Survey respondents were asked about their experience filing taxes.

Overall, those using Direct File in the pilot states report very high satisfaction with the service and very high likelihood to recommend it to others. Compared to those using alternatives, Direct Filers are much more likely to say tax filing this year was more straightforward than last year and that their costs and time spent filing were reduced.

Key FindingsKey Findings

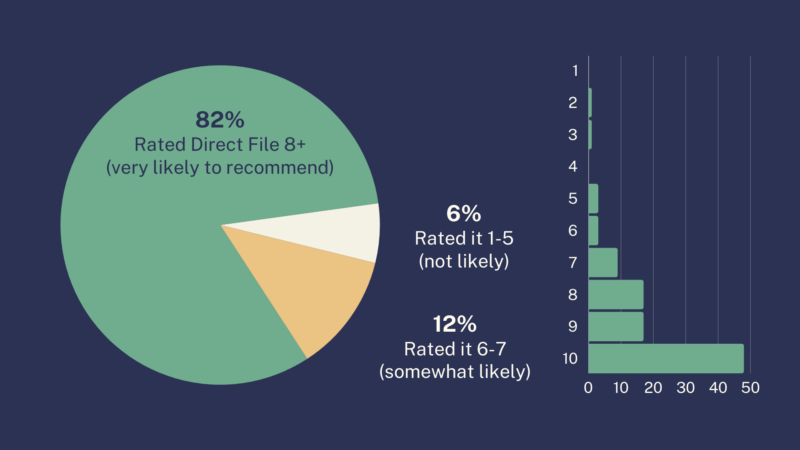

An overwhelming majority of users would recommend Direct File.

Direct File users were asked, on a 1 to 10 scale, how likely they are to recommend IRS Direct File. (Arizona and New York filers were also asked about FileYourStateTaxes.)

Eighty-two percent of Direct Filers give at least an 8 out of 10 likelihood to recommend. Ninety-one percent say at least 7 out of 10.

Three in four Direct Filers prefer it over alternatives.

Respondents were asked to compare their tax-filing experience this year to their experience last year, when Direct File was not available and they had to file taxes by using a professional tax preparer, paid or free software, or by doing taxes themselves.

Seventy-four percent of Direct Filers say they prefer it over their experience last year. Only 6% prefer to use a different filing method.

The preference for Direct File is strong across age, race, and partisanship, with at least 7 in 10 preferring Direct File among filers who are white, people of color, under or over age 45, and Biden or Trump voters. (see Appendix)

Solid majorities of Direct Filers say their filing experience was more straightforward this year and that they were more satisfied.

Asked to compare this year’s filing experience with last year when Direct File was not available, 61% of Direct Filers say their experience this year was more straightforward, including nearly a third saying it was much more straightforward.

About as many (58%) say they were more satisfied with their overall tax-filing experience this year, including 1 in 3 saying they were much more satisfied.

In contrast, among those using another method such as a professional tax preparer or paid software to file their taxes this year, only 25% said their experience was more straightforward (11% much more) while 73% said it was as complicated or more so than the year before. Just 24% said they were more satisfied (10% much more).

Direct Filers are far more likely than others to report lower costs.

Asked if it was more or less expensive to file their taxes this year, 44% of Direct Filers say it was less expensive, and 38% say costs were the same.

For those using other methods, only 10% say filing was less expensive this year, while 1 in 3 say it was more expensive.

Direct Filers are far more likely than others to report a faster experience, with most filing in less than an hour.

Among Direct Filers, 36% say it took them less time to do their taxes this year than last year, and 35% say it took the same amount of time. Sixty percent report that it took them less than an hour, including 15% who completed their taxes in less than 30 minutes.

Among those not using Direct File, 83% said it took the same or more time as the year before and just 13% report taking less time this year.

Methodology

David Binder Research conducted a survey of 4,261 adults nationwide who filed a tax return this year. This includes 440 taxpayers who used Direct File and 3,821 who did not. Interviews were conducted from March 13 through April 21, 2024.

The aim of this survey was to better understand the experiences and opinions of those using Direct File shortly after its launch. Because this group is relatively small among taxpayers and difficult to identify, a combination of nonprobability methods was used to extend the reach of this survey. This includes 3,958 interviews from online panels and 303 interviews from convenience samples of nonprofit membership organizations. The full sample was weighted to adult population benchmarks from U.S. Census data to be demographically aligned with the U.S. adult population. While margin of error cannot be calculated for a nonprobability sample, margin of error for an equivalent probability sample is ±1.5% for the 3,821 who did not use Direct File and ±4.7% for the 440 who used Direct File.

AppendixAppendix

| Preference among Direct Filers | |

| Prefer Direct File over Alternatives | |

| Total | 74% |

| White | 78 |

| People of color | 72 |

| Under 45 | 70 |

| Age 45+ | 79 |

| Voted Biden | 73 |

| Voted Trump | 80 |