Press Release

Half of U.S. States to Offer Free Tax Filing Through Direct File Starting Jan. 27

01. 10. 2025

Serving 25 states with new data pre-population feature, Direct File expands free, easy tax filing to millions more Americans this year.

WASHINGTON – The Treasury Department announced the expansion of IRS Direct File today with Illinois to become the 25th state to offer the tax filing tool, meaning half of U.S. states will now provide free, online, simplified filing through the IRS and their state websites this filing season. The agency also announced advanced new functionality to pre-populate taxpayers’ data, taking a huge step toward turning tax filing into a nearly-automatic experience.

“IRS Direct File is the free, easy tax filing solution that Americans crave, and we’re glad to see the IRS delivering on its promise to expand the tool and make it permanent for 32 million American households across 25 states,” said Adam Ruben, Vice President of Campaigns and Political Strategy at Economic Security Project. “Filing for free – and having the IRS automatically fill in your tax forms for you with the information they already have – should be the standard practice here like it is in so many other countries.”

These expansions follow last year’s successful pilot, where the overwhelming majority of users reported a positive experience with the simple, secure tool that saves taxpayers both time and money. The announcement comes as the IRS prepares to open the 2025 tax season on January 27.

“Taxpayers shouldn’t have to pay exorbitant fees to predatory for-profit companies just to file their taxes,” said Lindsay Owens, Executive Director of Groundwork Collaborative. “Direct File has already proven enormously popular, putting money back into the pockets of working families. We’re excited that millions more Americans will be able to file their taxes for free this tax season – proof that investing in the IRS pays off for taxpayers.”

The IRS also announced a significant leap forward in the way people file their taxes: beginning in 2025, Direct File will prepopulate taxpayers’ personal and wage information. For decades, experts have advocated for this approach, common around the world, of using information the government already has on file to automate the tax filing process. This will fundamentally modernize the tax filing process, save Americans both time and money, and remove barriers to filing returns. The 2025 functionality is only a first step; when it is fully scaled and implemented, Direct File’s data import functionality will make tax filing nearly automatic for many Americans.

“Pre-population will make it easier for millions of people to file taxes, while saving government time, too,” said Amanda Renteria, CEO of Code for America. “This is a meaningful step toward addressing one of the burdens Americans face in filing their taxes and creating the free, accessible, and easy-to-use tax filing system that taxpayers deserve.”

With Illinois now on the list of states where Direct File is available, more than 32 million households can file their taxes for free directly with the IRS and easily access the tax credits they qualify for and deserve.

“Before IRS Direct File, I was filing paper tax returns to avoid the gimmicks and confusion of online filing software,” said Loren Dalbert, a California taxpayer who used Direct File last year. “The Direct File tool is a huge time-saver compared to paper filing, was incredibly easy to use last year, did not include ads or sales pitches, and is something I plan to use again this tax season.”

Last year, over 140,000 tax filers in 12 states used IRS Direct File to securely file their taxes for free. Research shows that when the program is made fully available in all 50 states and for various tax situations, IRS Direct File could save taxpayers $11 billion annually in cost and time savings. Direct File would also meaningfully close the long-standing refundable credits coverage gap by making sure that households can claim up to $12 billion annually in tax credits like the Earned Income Tax Credit (EITC) and Child Tax Credit (CTC) that are too often left on the table because people didn’t file their taxes.

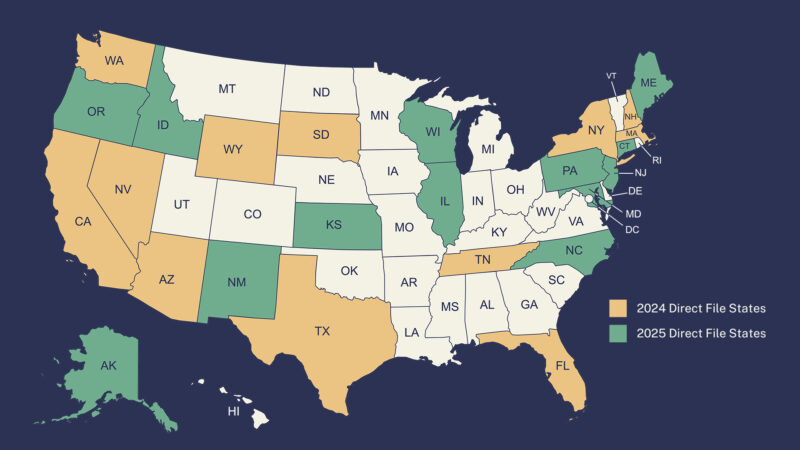

Direct File is available to taxpayers in the following states in 2025: Alaska, Arizona, California, Connecticut, Florida, Idaho, Illinois, Kansas, Maine, Maryland, Massachusetts, Nevada, New Hampshire, New Jersey, New Mexico, New York, North Carolina, Oregon, Pennsylvania, South Dakota, Tennessee, Texas, Washington, Wisconsin, and Wyoming.

The tool will also be able to serve filers with additional tax situations, as compared to last year, allowing taxpayers to claim the Credit for Other Dependents, Child and Dependent Care Credit, Premium Tax Credit, Retirement Savings Contributions Credit, as well as the deduction for Health Savings Accounts, among many other expansions. Direct File will also support 1099s for interest income greater than $1,500, retirement income, and 1099-MISC for Alaska residents who receive the Alaska Permanent Fund dividend.

If you are interested in speaking further about Direct File with a member of the Coalition For Free And Fair Filing, please contact Jenna Severson at [email protected] or Manisha Sunil at [email protected].

###

The Coalition for Free and Fair Filing supports the Internal Revenue Service’s efforts to create a free online direct tax filing tool. The group’s mission is to ensure all U.S. taxpayers can easily file tax returns and get the tax credits they deserve by safeguarding and expanding the IRS Direct File program. The coalition is composed of organizations committed to racial and economic justice, consumer protection, the advancement of civic technology and the promotion of equity in tax administration.