Tax Fight 2025

A Tax System Worth Fighting For

12. 13. 2024

Building a tax code that promotes fairness at the top and bottom and puts families and workers ahead of corporations and billionaires

Trump’s Tax Plan Cuts Taxes For The Top 5% — And Raises Them For Everyone Else

With many provisions of the Trump Tax Cuts and Jobs Act (TCJA) set to expire at the end of 2025—including many of the biggest individual tax cuts for the wealthy and the $2,000 Child Tax Credit—Republicans are proposing a new round of tax cuts for the wealthiest and huge corporations. The resulting tax fight will be one of the biggest economic issues in Congress next year. While the opportunity is on the table to significantly improve people’s lives by making taxes more fair at the bottom and the top, instead Trump’s tax proposals would:

- Give huge new tax cuts to the wealthiest

- Exempt certain types of income like tips, overtime pay, and Social Security

- Cut the corporate tax rate even more

- Repeal green energy incentives

- Impose costly new tariffs of 20% on imported goods, with a higher rate of 60% on products from China

Trump’s plan would cut taxes for the richest 1% by an average of $36,000 and raise taxes for the bottom 95% of Americans by more than $1,200.

Americans Are Struggling While Corporate Profits Skyrocket

For most Americans, the rising cost of living has made it increasingly difficult to get by, let alone get ahead. Even with inflation slowing and a stable job market, corporations have used their market power to keep the prices of everyday necessities like groceries, gas, and rent high and rising. And while wages have grown with inflation, especially low-wage sectors, they have not grown across every sector. Too many families simply can’t balance the budget each month.

For the ultrawealthy and powerful corporations, the story is the opposite. In the decade before the COVID recession, corporate profits have skyrocketed as businesses have shifted $600 billion per year from workers’ wages to profits for business owners and investors. Since the start of the COVID pandemic, billionaires in the U.S. have virtually doubled their combined wealth, largely off the backs of American workers and consumers. While some of the biggest American businesses grew $1.5 trillion richer coming out of the pandemic recession, their workers saw less than 2% of that benefit. Our economy has grown more concentrated, and corporations charge consumers more even as their input costs have come down.

Refundable Tax Credits Put Billions Of Dollars In Americans’ Pockets

While California has put in place substantial state tax credits which are more inclusive than federal credits in important ways, the federal CTC and Earned Income Tax Credit (EITC) are much larger, putting money back in the pockets of individuals and families who actually spend it, boosting local economies and helping small businesses flourish.

Not only did the American Rescue Plan’s expanded CTC in 2021 drive the greatest reduction in child poverty ever recorded, the CTC and EITC also have the potential to narrow racial disparities created by generations of unequal access to economic opportunity. A strong and growing body of research shows that in just six months, the expanded CTC slashed child poverty, created private-sector jobs, and made it easier for parents to work, get professional training, or start new businesses. Similarly, the expanded EITC provided financial relief for 15 million workers, particularly those without kids in the home, including 1.8M in California, who are the only group taxed into, or further into, poverty by our tax code.

Unlike the TCJA, research is clear that these tax credits pay for themselves. They have immediate impacts on local economies, and generate $10 for every $1 invested in lifetime and economic benefits. In stark contrast, the TCJA corporate giveaways only returned 15 cents for every $1 invested.

Commonsense Tax Policies Could Put $20 Billion In The Pockets Of California Families

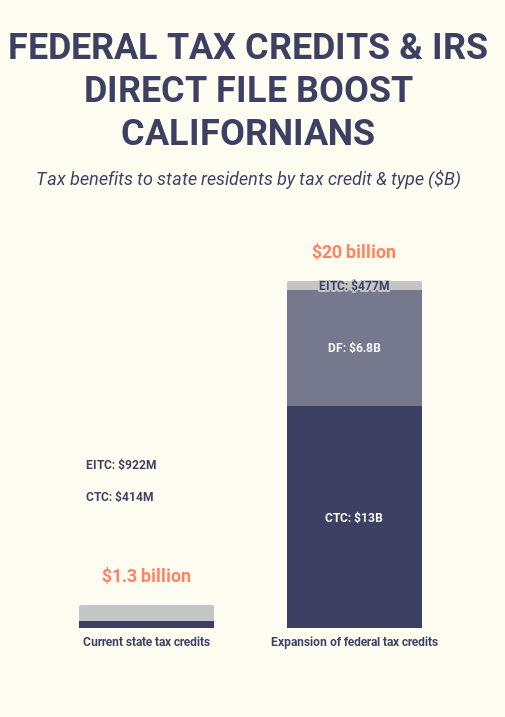

California has made steady expansions to its CalEITC and Young Child Tax Credit since they were each enacted, providing nearly $1.3 billion per year in targeted refundable tax credits to low- and moderate-income families and individuals. Combined, California has some of the most generous tax credit policies in America.

Nationally, the state tax credit movement has won over $4 billion a year in expansions across 20 states over the past two remarkable years—but expanding the federal CTC and EITC again, as they were in 2021, could be worth over $100 billion a year.

Compare the value of these state tax credits to the potential value of expanded federal tax credits in California: expanding the federal CTC could bring $13 billion a year into the state; expanding the EITC could bring in $477 million; and savings from Direct File could rise to $6.8 billion between tax preparation cost savings and additional tax credits claimed. That’s $20 billion dollars in the pockets of low- and middle-income California families if Congress put families and workers ahead of corporations and billionaires.

Targeted expansions to the federal CTC could cut child poverty in half at no cost to the state. The fully refundable, monthly federal CTC passed as part of the American Rescue Plan Act (ARPA) in 2021 cut child poverty nearly in half to its lowest rate in recorded history. In California, the expanded CTC benefited 7.9 million kids—88% of children in the state— and lifted 553,000 of them out of poverty. Right now, 20% of the lowest-income children in the state are excluded from the full credit because their families earn too little.

In 2025, Congress can choose to put money into American families’ pockets or give more costly tax breaks to billionaires and profitable corporations. At minimum, Congress must raise more revenue while making the tax code fairer at the top and bottom of the income ladder.

That means no tax breaks for the wealthy and profitable corporations that make the tax code even more unequal and the economy even more precarious. And it means targeting tax benefits to families through fully refundable tax credits. The CTC must be amended to reinstate eligibility for immigrant children with ITINs, and any amendments to the CTC and EITC must not reduce benefits for low- and middle-income families from current law—including and especially immigrant families who have so often been the political targets of the Trump administration.

IRS Direct File Amplifies The Positive Impact Of Smart Tax Policies

In 2024, IRS rolled out Direct File, a new public option for free and simplified tax filing. By making tax filing free and easy, with simple, interview-style questions, Direct File removes the biggest barriers to tax filing: cost, difficulty, and unscrupulous tax preparers. These barriers disproportionately affect low-income families and families of color, who lose out on valuable tax credits because of barriers to tax filing.

During its 2024 pilot year, Direct File was available in 12 states; in 2025, it will be available to 30 million tax filers in 24 states. Once it’s at full scale, Direct File will save Americans $23 billion annually between filing fees, time costs, and increased access to valuable tax credits for low-income families currently missing out.

A Repeat Of The 2017 Tax Cuts And Jobs Act Would Exacerbate Inequality And Wreck Our Economy

The TCJA was passed in 2017 as a giant boon to the top 1% and most powerful corporations. The largest tax overhaul in three decades, it gave huge businesses and their wealthy shareholders even more tax breaks by permanently cutting the corporate tax rate from 35% to 21% and temporarily cutting personal income, estate, and capital gains taxes, overwhelmingly benefitting the wealthiest at the expense of working families and small businesses.

Far from cutting costs or “paying for itself,” the TCJA is ballooning the national debt to put more money in the pockets of the top 1%. While Americans in the bottom 80% of incomes have seen an average tax cut of $763 a year—in significant part from doubling the Child Tax Credit (CTC) from $1,000 to $2,000—the top 1% have gotten $60,000, and the top 0.1% have gotten $250,000. The TCJA has likewise failed to produce higher wages—as promised— among rank-and-file workers and is adding $2 trillion to the nation’s deficit. Predictably, Republicans in Congress propose to reduce the deficit by cutting Medicare and Social Security. Subjecting Americans to a decade more of failed Trump tax policies will only increase inequality, taking power from the American people and further concentrating it in the hands of the wealthiest and most powerful few.