Cash Tax Credits

Momentum Grows for State Tax Credit Programs with Key Legislative Wins

12. 19. 2023

In 2021, seven states had a permanent state-level Child Tax Credit; now, 14 states do.

Update: Read the new fact sheet for 2024

Significant Legislative Wins in Last Two Years for State Tax Credit Programs

Visit link:The expiration of the expanded federal Child Tax Credit at the end of December 2021 left families struggling to make ends meet. Fortunately, local leaders across the country have come together to cross the aisle and pass pragmatic, bipartisan policies that put more cash in families’ pockets to help put food on the table, buy school clothes, and get to work. State-level tax credit programs advancing across the country can both significantly improve people’s standard of living and ensure they’re weathering rising costs. Many statehouses have also looked to lessons learned around tax credit implementation from the federal level, adding provisions to ensure benefits are accessible for all families – including children of immigrants – and distributed out periodically throughout the year.

The following outlines recent progress to secure Child Tax Credits and Earned Income Tax Credits in states, and outlines the tremendous impact those policies will have on American families.

Tax Credit Nationwide Trends – By the Numbers

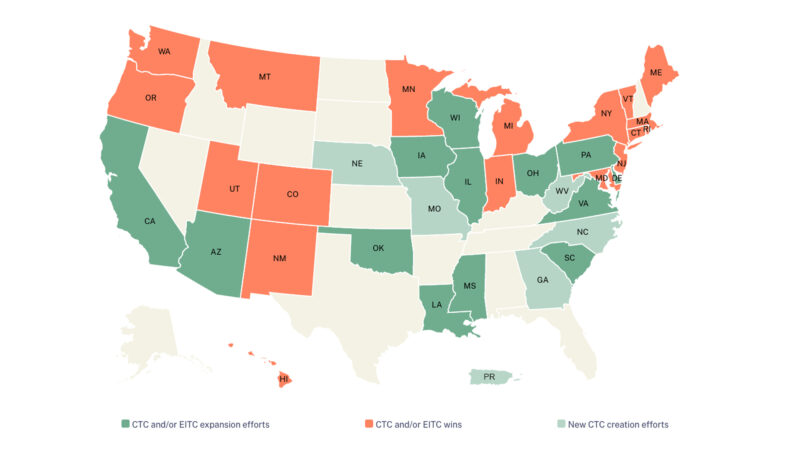

- In 2023, 36 states and the District of Columbia took action or considered legislation to expand their state-level tax credits.

- 18 states passed policies in this past legislative session that improved, expanded, or created a Child Tax Credit (CTC) or Earned Income Tax Credit (EITC).

- $600 more on average were invested in low- and middle-income households per year. This falls short of the $3,600 per-child credit that Congress slashed to $2,000 when they failed to extend the expanded, fully refundable federal Child Tax Credit, but it’s a step in the right direction.

- An additional $2 billion will be invested in more than 4 million households across 18 states when people file their taxes in 2024 due to expansions passed in 2023 alone.

- In 2021, 7 states had a permanent state-level Child Tax Credit; now, 14 states do: CA, CO, ID, ME, MD, MA, MN, NJ, NM, NY, OK, OR, UT, VT.

18 Tax Credit Legislative Wins in 2023

- Colorado

- Policy: Removes earnings test from the CTC; increases the EITC from a 10% federal match to a 25% match; includes all immigrant residents in both policies

- Households impacted: 459,500 (CTC + EITC)

- Credit amount: $200, $600, or $1,200 (CTC) and $150-$1,857 (EITC) – depending on income and filing status

- Additional annual investment in households: $182 million

- Note: The CO legislature achieved these policy expansions in separate sessions – with the one-time EITC increase coming in special session in Nov. 2023

- Connecticut

- Policy: Increases EITC from 30.5% federal match to a 40% match

- Households impacted: 211,000 (EITC)

- Credit amount: $240-$2,972 (EITC)

- Additional annual investment in households: $45 million (EITC)

- Hawaii

- Policy: Doubles the EITC from a 20% match of the federal EITC to a 40% match

- Households impacted: 64,400 (EITC)

- Credit amount: $240-$2,972 (EITC)

- Additional annual investment in households: $42 million (EITC)

- Indiana

- Policy: Recouples state EITC to federal EITC at a 10% match

- Households impacted: 539,000 (EITC)

- Credit amount: $60-$743 (EITC)

- Additional annual investment in households: $19 million (EITC)

- Maine

- Policy: Makes the state CTC fully refundable

- Credit amount: $300 per child or other dependent (CTC)

- Additional annual investment in households: $20 million (CTC)

- Maryland

- Policy: Creates a new permanent CTC for young children; increases EITC; both were expanded to include ITIN filers

- Children impacted: 440,000 (CTC)

- Credit amount: $500 per child (CTC); up to $560 per adult (EITC)

- Additional annual investment in households: $172 million (EITC + CTC)

- Massachusetts

- Policy: More than doubles the state’s CTC from $180 to $440, and increases the state’s EITC from a 30% federal match to a 40% match.

- Households impacted: 565,000 (CTC)

- Credit amount: $440 (CTC); $240-$2,972 (EITC)

- Additional annual investment in households: $307 million (CTC)

- Michigan

- Policy: Quintuples the EITC from a 6% match of the federal EITC to a 30% match

- Households impacted: 700,000 (EITC)

- Credit amount: $180-$2,229 (EITC)

- Additional annual investment in households: $384 million (EITC)

- Minnesota

- Policy: Creates a new CTC of $1,750 for families earning up to $35,000, including ITIN filers; changes EITC to target adult dependents and workers without children in the home; allows state to provide advance payments

- Households impacted: Est. 250,000 (CTC)

- Credit amount: $1,750 (CTC); $350 (EITC adults without children)

- Additional annual investment in households: $419 million (EITC + CTC)

- Montana

- Policy: Increases EITC from 3% federal match to a 10% match

- Households impacted: 72,000 (EITC)

- Credit amount: $60-$743 (EITC)

- Additional annual investment in households: $11 million (EITC)

- New Jersey

- Policy: Doubles the state’s Child Tax Credit from $500 to $1,000 per child age 5 and under

- Children impacted: 372,000 (CTC)

- Credit amount: $1,000 per child (CTC)

- Additional annual investment in households: $123 million (CTC)

- New Mexico

- Policy: More than triples the CTC; expands eligibility to married people filing separately, a policy change that will support domestic violence survivors

- Households impacted: 200,000 (CTC)

- Credit amount: $600 per child (CTC)

- Additional annual investment in households: $103 million (CTC)

- New York

- Policy: Expands existing Child Tax Credit to include children under age 4

- Households impacted: 900,000 (CTC)

- Credit amount: $330 per child (CTC)

- Additional annual investment in households: $179 million (CTC)

- Oregon

- Policy: Creates a new $1,000 refundable credit for children ages 6 and under in low-income families, including ITIN filers; requires state to set up a system for advance quarterly payments

- Children impacted: 55,000 (CTC)

- Credit amount: $1,000 (CTC)

- Additional annual investment in households: $35 million (CTC)

- Rhode Island

- Policy: Increases EITC from a 15% federal match to a 16% match

- Households impacted: 85,500 (EITC)

- Credit amount: $96-$1,189

- Additional annual investment in households: $2.2 million (EITC)

- Utah

- Policy: Creates a new $1,000 Child Tax Credit for children ages 1-3 in low-income households and increases the state’s EITC

- Households impacted: 20,900 (CTC)

- Credit amount: $1,000 (CTC)

- Additional annual investment in households: $10 million (CTC)

- Vermont

- Policy: Expands CTC and EITC to all immigrant residents; requires state to set up a system for advance quarterly payments

- Washington

- Policy: Expands EITC eligibility to married people filing separately, and provides taxpayers with three years to claim their credits retroactively

- Households impacted: 6,000 additional taxpayers (EITC)

- Credit amount: Up to $1,200 (EITC)

- Additional annual investment in households: $3 million (EITC)