Federal CTC and EITC

Monthly Child Tax Credit Keeps More Kids Out of Poverty All Year

05. 06. 2022

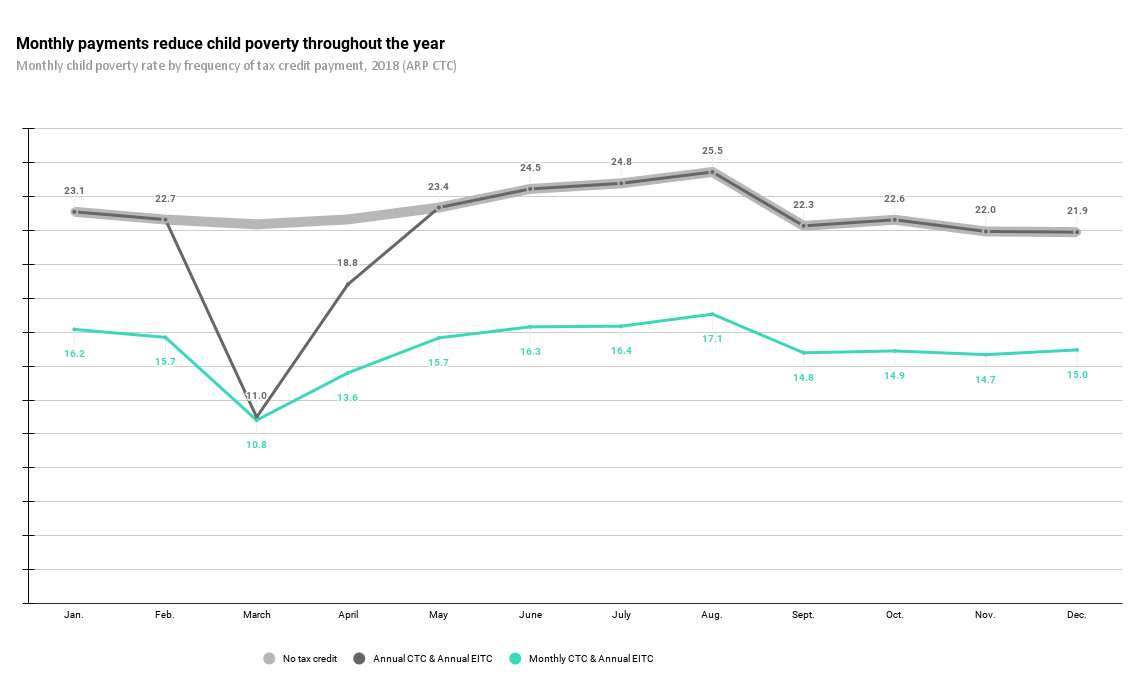

Monthly CTC payments can keep more kids out of poverty each month than one-time annual payments.

Click to add an image!

Monthly payments keep kids out of poverty all year. As is widely known, the expanded, fully refundable monthly Child Tax Credit in 2021 lifted nearly 4 million children out of poverty, and its expiration has thrown them back into poverty.

A groundbreaking new analysis from Columbia University shows that while the annual poverty impacts are the same, monthly CTC payments can keep more kids out of poverty each month than one-time annual payments. The analysis shows impacts in a typical year, and suggests that if Congress extended the CTC and continued to provide monthly payments, the poverty impacts around tax time would be comparable to an annual lump sum, but monthly payments would lift about one-third more children above the poverty line each month on average – for essentially the same amount of money. Compared to annual payments, child poverty rates would be consistently lower by 6.8 percentage points on average with monthly payments. If the EITC were also paid monthly, that would reduce average monthly poverty by another 1.3 points.

Parents and other caregivers prefer monthly payments to lump-sum refunds at tax time. Regular infusions of cash reduce stress, so it’s no surprise that parents and other caregivers prefer them. The Chicago EITC Periodic Payment Pilot found that 90% of those who received periodic payments preferred them to a lump sum, and a majority of families earning $50K and below preferred a periodic option for tax credits. In a July 2022 survey by the Urban Institute, researchers found that 45 percent of nonelderly adults living with children preferred the advance CTC payments, whereas 27 percent preferred a single payment as part of a tax refund and 28 percent had no preference.

Monthly payments cut reliance on payday loans and other risky financial tools. Income volatility – destabilizing swings in income from month to month – disproportionately affects Black, Latinx, and families with low incomes, leading many families to turn to risky financial services like payday loans to get by. Recent research from Appalachian State University, Washington University in St. Louis, and Tax Policy Center shows that the monthly CTC payments helped families cut their reliance on these risky financial products. CTC recipients saw declines in credit card debt, and were 1.7 to 2 times more likely than non-eligible households to reduce reliance on payday loans, pawn shops, and even selling blood plasma.

Monthly payments track families’ real-time needs. Most basic expenses – like rent, utility bills, or food – come due monthly or even more frequently. When families can’t make ends meet each month, they often take on debt through credit cards or payday loans to make ends meet. Data from stimulus checks showed this: as relief from one-time checks ran out, people increased their reliance on credit cards to meet basic needs. So while families do spend annual tax refunds on basic needs, and some people can boost their savings, data from the EITC show that nearly all tax credit recipients spend some of their annual credit on unpaid bills or digging out of debt. Monthly CTC payments can help families in real time – and keep them from falling into debt in the first place.

Monthly CTC payments increased family incomes by $444 per month. In the second half of 2021, IRS sent average monthly payments of $444 to nearly 40 million households. The full 2021 expanded CTC is estimated to increase incomes among the lowest-income households by more than a third. These payments were critical to helping families stay afloat as the latest stimulus checks ran out, likely helping families with kids maintain cash balances for longer.

Monthly payments help parents get back to work. Though economists have come to different conclusions in predicting potential effects of CTC on employment, the real-world experience shows that monthly CTC payments in fact had no discernible negative effect on employment. In fact, the share of parents who cited needing to care for children as the reason for unemployment dropped by 23 percent, suggesting that the payments reduced an important barrier to employment for many low-income parents.

Monthly CTC payments increase racial equity. The current TCJA version of the CTC lacks full refundability, excluding nearly half of Black and Latinx children from the full credit, so children of color stand to gain the most from the credit’s anti-poverty impacts from full refundability. As the IRS reached more eligible children over the course of the six months of payments, Black and Latinx kids likely saw greater anti-poverty gains. Combining monthly payments with a fully refundable credit reduces the disparities between white children and children of color compared to the TCJA.

Monthly payments help families keep up with regular expenses, like food, housing, and bills. The most common uses of the monthly CTC are food, utility bills, clothing, rent, and paying down credit cards, student loans, or other debt. Monthly CTC payments:

- Kept kids fed. After the first monthly CTC payment was sent in July, food insufficiency among families with kids fell by 24 percent, and Improvements were significant among Black and Latinx families, who experience the highest rates of food hardship.

- Kept kids in safe homes. In a survey of low-income families, three-quarters of SNAP recipients used their CTC payments on bills, including to prevent utility shutoffs and evictions or foreclosures.

- Helped parents keep up with regular expenses. After the first checks went out, households with children experienced an 8 percent drop in difficulty meeting expenses, compared to a 5 percent increase for families without kids over the same period.

- Helped parents pay for child care. Families with younger children used their payments on child care when school started in late August and early September.