State CTC and EITC

State Child Tax Credits and Child Poverty: A 50-State Analysis

11. 16. 2022

This report provides new data on state options for developing or expanding state CTC's that can achieve ambitious child poverty reductions

This report was authored by Sophie Collyer, Megan Curran, Aidan Davis, David Harris and Christopher Wimer and conducted by the Institute on Taxation and Economic Policy and the Center on Poverty and Social Policy at Columbia University on behalf of Share Our Strength, with additional support from the Annie E. Casey Foundation, the Charles and Lynn Schusterman Foundation, the Economic Security Project, The JPB Foundation, the W.K. Kellogg Foundation and the Rockefeller Foundation. Click to read the full report.

Key Findings

- The temporary 2021 federal Child Tax Credit expansion dramatically reduced child poverty and material hardship. Extending the federal policy would provide the broadest poverty reduction across the country. States can also build on the success of the credit. This report presents state Child Tax Credit options that would reduce state child poverty rates by 25 or 50 percent when coupled with existing federal law, which provides a maximum of $2,000 per child, is not fully refundable and phases in with earnings.

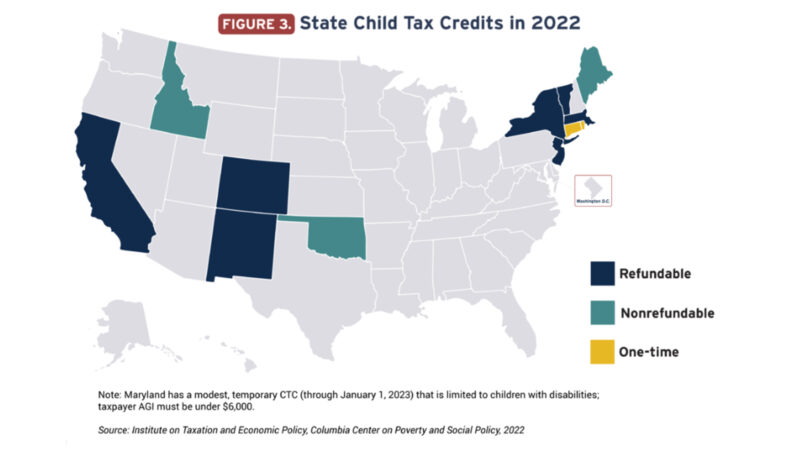

- There is increasing momentum in the states toward adopting and expanding Child Tax Credits. Heading into 2023, ten states currently have some form of a Child Tax Credit and many others are considering one.

- To make a state Child Tax Credit most effective, lawmakers should consider a range of design principles, including making children in families with low or no earnings eligible for the full credit, tying benefits to the number of children in a family, adjusting the credit amount annually with inflation to ensure that it does not erode over time and providing the credit in monthly installments.

- In almost all states, a refundable state Child Tax Credit of $2,000 or less – with a 20 percent credit boost for young children under 6 – would achieve a 25 percent reduction (or more) in the child poverty rate. Most states would see a child poverty reduction of 25 percent with a base credit value between $1,200 and $1,800.

- To cut child poverty rates by half, the majority of states would require a base credit value of between $3,000 and $4,500 per child plus a 20 percent boost for young children. If the federal Child Tax Credit expansion is reinstated, the same goals could be achieved through smaller state credits.

- A twenty-five percent child poverty reduction in each state would collectively cost states 2.6 percent of total nationwide state and local revenue under the more universal Child Tax Credit. Under a more targeted approach, the overall cost to all states would be 1.7 percent of total state and local revenue.

- Fifty percent child poverty reduction in each state would collectively cost states 7.0 percent of total nationwide state and local revenue under a more universal Child Tax Credit option that extends higher up the income scale and is available to more middle-class families.

- Two thirds of states could halve child poverty by dedicating less than 5.5 percent of total state revenue under a more targeted approach that directs benefits primarily toward families experiencing low income. The amounts that states would need to invest to achieve sizeable cuts in child poverty, while significant, are within reach for states willing to commit the resources.