Federal CTC and EITC

Understanding Five Major Federal Tax Credit Proposals

05. 22. 2019

One possible response to the challenges of poverty and declining wages is to use the tax code to boost incomes of low- and moderate-income people.

This article originally appeared in the Institute on Taxation and Economic Policy

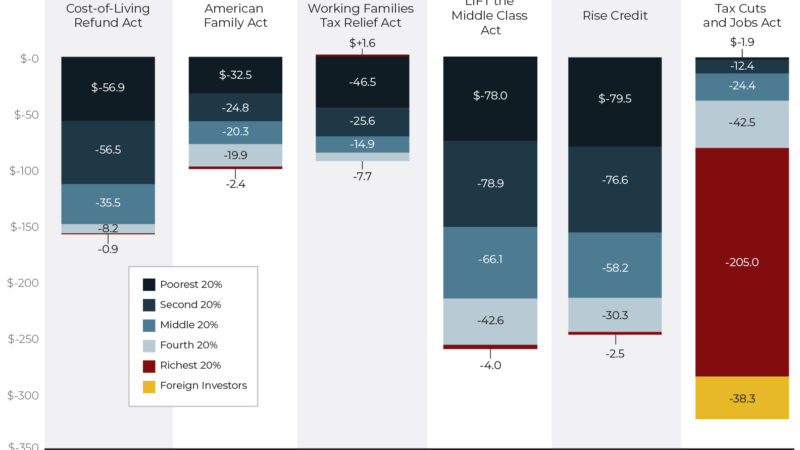

“Federal lawmakers have recently announced at least five proposals to significantly expand existing tax credits or create new ones to benefit low- and moderate-income people. While these proposals vary a great deal and take different approaches, all would primarily benefit taxpayers who received only a small share of benefits from the Tax Cuts and Jobs Act.”