State-level tax credit programs put more cash in families’ pockets.

Local leaders across the country have come together to cross the aisle to pass pragmatic, bipartisan policies.

Local leaders across the country have come together to cross the aisle to pass pragmatic, bipartisan policies.

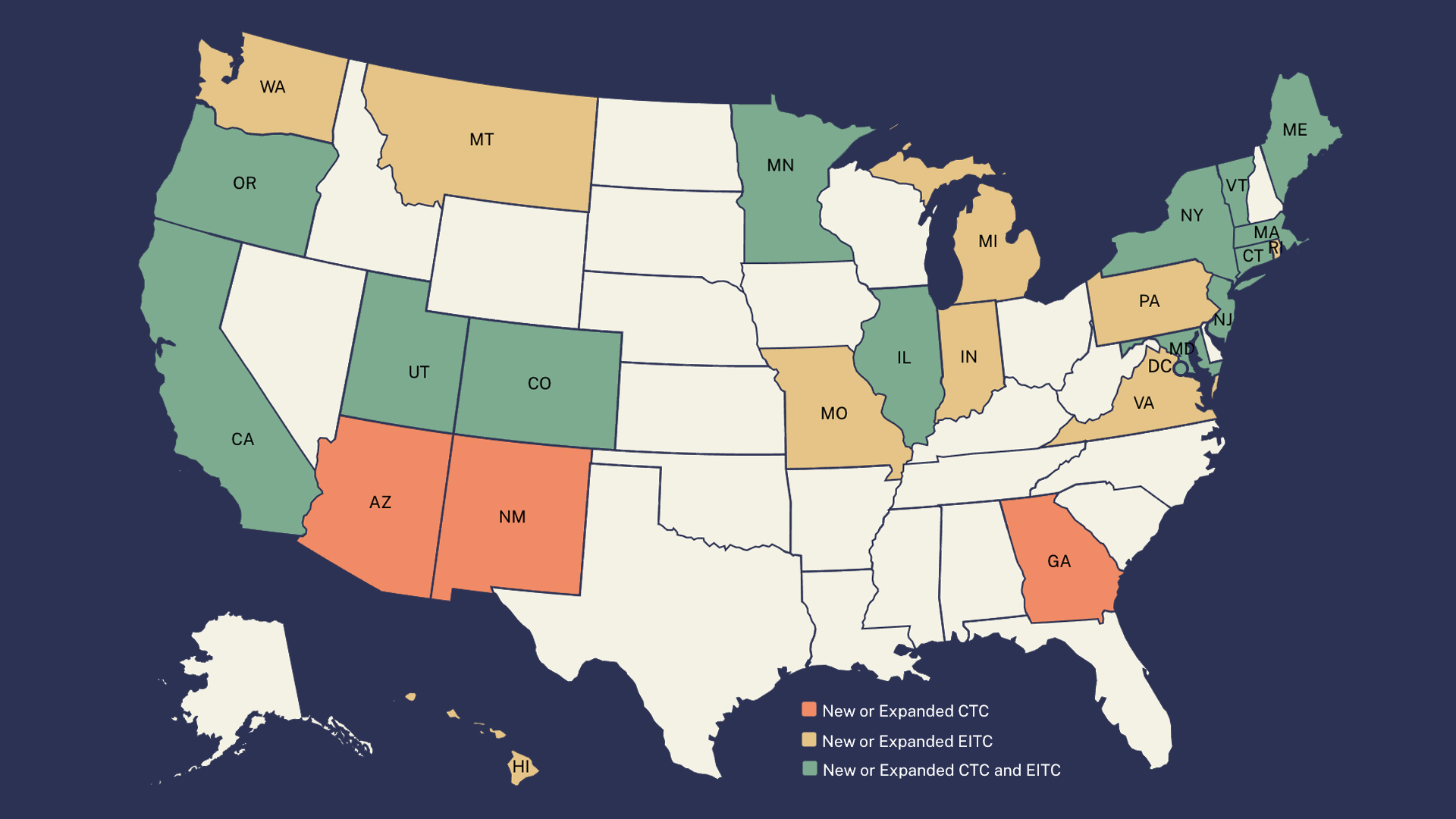

Visit resource page: Since the Federal Expanded CTC Expired in 2021, 22 States and DC Have Passed New or Expanded Tax Credits

Visit resource page: Illinois Budget Doubles Child Tax Credit in Major Win for Working Families

Visit resource page: Get Money Back with the Illinois Child Tax Credit and Earned Income Credit

Visit resource page: Cashing In: Winning Big Bold Tax Credits In States

Visit resource page: Enhancing Child Well-Being with Cash Assistance

Visit resource page: State Child Tax Credits and Child Poverty: A 50-State Analysis

Cash is the currency of life – it’s what we use to provide food and housing for ourselves and our families, to pay for childcare, to get to and from work, to buy what we need. Cash offers the freedom to make choices, and the resources to create stability. And cash–when provided directly through targeted tax credits to the people who need it most – becomes one of the most powerful, practical tools available for people to be able to meet their needs and have agency over their lives.

While the federal government is the biggest player in providing cash tax credits, states play a critical role. States can respond to the needs of local communities, filling in gaps in the federal scheme to address people’s specific needs. By making sure cash goes to those who need it, states can ensure the biggest impact for the maximum number of families.

ChallengeThirty-one states, alongside Washington D.C. and Puerto Rico, provide direct cash transfers in the form of tax credits–typically Earned Income Tax Credits to boost low wages, and increasingly, Child Tax Credits to support families. States structure these credits in a myriad of ways, but like their federal counterparts, state credits often have exclusions or conditions that limit their reach and effectiveness. For example, many tax credits have income requirements, which means people who engage in work that doesn’t earn a paycheck — like taking care of young kids or getting a college degree — aren’t eligible. Some state tax credits exclude non-citizens, even though they pay taxes just the same. And outmoded tax filing systems put the burden on people to overcome a complicated and expensive process just to provide information that in many cases the state already knows. Finally, although we know that paying credits monthly supercharges their impact (for the same amount of money), most states still pay out only once a year, in a lump sum.

So even though we know that unrestricted cash through generous, automatic and monthly tax credits is a simple solution to address poverty and the rising cost of living, many existing state tax policies perpetuate outdated, complicated, exclusionary and often racist systems. We’re working to change this.

What We DoWe bring together individuals, organizations, and like-minded lawmakers around the idea that unrestricted cash is the most efficient and effective way to improve people’s lives. We help build and support state campaigns headed by changemakers on the ground and give them the resources they need to build powerful coalitions of experts, communicators, organizers, and advocates. We advance bold ideas to transform state tax codes into mechanisms for getting unrestricted cash to families. Our goal is a network of state tax credits that are generous in value, inclusive in eligibility and modern in administration. We want to see the states pick up where federal tax credits leave off, so that people of every state can rely on direct cash payments when they need financial support.

Let’s make it easier for everyone to get the tax credits they’re owed.

Visit link: Let’s make it easier for everyone to get the tax credits they’re owed.Ultimately, we are laying the groundwork for a national guaranteed income–because people know best how to use the money to make their lives better.

ImpactWe’re supporting campaigns in states across the country – resulting in wins that have delivered millions of dollars in people’s pockets. We and our in-state partners have worked together to pass bills that eliminate income requirements, and increase the amount of cash delivered while expanding eligibility for young people, the elderly, immigrants, and low and middle-income families.

California Campaigns Director

Illinois Policy and Advocacy Director

California Director of Strategic Initiatives

Vice President, Economic Security California

Director of Economic Security Illinois

Communications Director

Senior Director of Campaigns Research