It should be free and easy to file your taxes.

A public option for tax filing counters corporate power to make tax filing free and simple and ensure that everyone gets the money they are owed.

A public option for tax filing counters corporate power to make tax filing free and simple and ensure that everyone gets the money they are owed.

Visit resource page: New Treasury Report Shows Trump Administration Officially Kills Popular Direct File Tool as a Favor to Tax Prep Industry

Visit resource page: Charting the Path to Keep Direct File Alive: A Recap of ESP’s Future of Tax Filing Fellowship Convening

Visit resource page: States should look beyond Direct File to keep the spirit of reform alive

Visit resource page: FEDSCOOP: Direct File died under Trump. Meet the creators planning for its second life

Visit resource page: National Taxpayer Survey: Opinion on Direct File vs. Alternatives

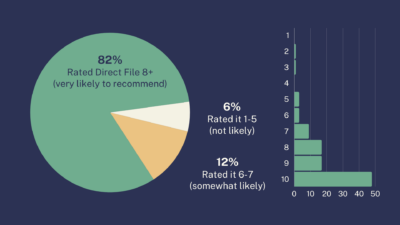

Visit resource page: The Impact of Direct File—by the Numbers

A publicly-owned, free and straightforward tool to file taxes directly with the IRS will save families time, money, and effort and put crucial benefits within reach for families that are currently missing out. This is an attainable goal – the IRS has the necessary data, expertise, and capacity to build this tool. Dozens of other countries like the United Kingdom, Germany, and Japan have this free tool, and their filing process takes less than 10 minutes to complete. By creating a system that takes the costs and headache out of tax filing for tens of millions of Americans, the IRS has the power to ensure more people get the refunds and credits they deserve.

The IRS estimates that an average taxpayer spends 13 hours and $140 each year to fulfill their tax filing obligation, leading to billions of dollars diverted from people receiving refundable credits to commercial tax preparation services. Millions more families find these and other tax-filing barriers insurmountable and don’t or can’t file taxes. For example, the IRS estimates that 21% of those eligible for the EITC do not claim it, and millions of children, disproportionately children of color, likely missed out on the expanded CTC in 2021 because of barriers to filling.

hours the avg. taxpayer spends filing annually

the amount the avg. taxpayer spends annually to file

In addition, the tax prep industry lobbies to continue making billions of dollars off of Americans every year, siphoning off cash that is meant for these families with their extractive fees. Their profit margin is dependent on their ability to mislead the public – TurboTax recently had to pay taxpayers $141 million for deceptively steering customers into paying for tax preparation – even though they qualified for a free government program.

The burdensome filing process coupled with the high cost of tax prep services makes it harder for people to access the tax credits they are owed, and could actually work to widen racial disparities in poverty.

What We DoWe are organizing and resourcing a movement behind the creation of public options that build economic power for all Americans. We bring together allies all over the country to demand that every taxpayer has the option to use a free IRS-run tax filing tool. We build and amplify the support of key constituencies, including racial justice organizers for increased accessibility of cash tax credits like the CTC and EITC. We are making the case for better access to the tax code and cash tax credits with compelling data and polling that shows the overwhelming popularity of this public option.

It’s time for a tax filing public option – and a win for hardworking Americans against dominant corporations.

This is a coalition centered on making government work for the people. Recently, this principle was born out through IRS’s implementation of automatic advance CTC payments in 2021, alongside a simplified filing portal for those without a filing obligation, drastically reduced child poverty and increased trust in government. Nationwide surveys showed that the automatic CTC made recipients feel like the government cares about their family’s health and wellbeing and is responsive to the needs of their community — findings that are more pronounced for Black and Hispanic respondents. A public option for tax filing would build on these positive steps – while providing necessary competition in a market dominated by two major corporations that spend millions of dollars every year to lobby against this progress.

It’s time for a tax filing public option – and a win for hardworking Americans against dominant corporations.

To learn more about The Coalition for Free and Fair Filing, visit freeandfairfiling.org.