Automatic cash creates a more resilient economy.

By ensuring that families have the resources they need in all economic conditions, we can fight racial disparities and enhance trust in governance.

By ensuring that families have the resources they need in all economic conditions, we can fight racial disparities and enhance trust in governance.

01. 09. 2024

Visit resource page: Preparing for the Next Recession: How Policymakers Can Safeguard Families and the U.S. Economy

12. 14. 2023

Visit resource page: Direct Cash Payments in the Next Recession

12. 14. 2023

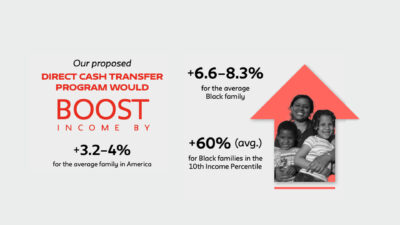

Visit resource page: New Report Urges Congress to Establish Automatic Direct Cash Payments for the Next RecessionThe impacts of economic downturns can be mitigated through timely and targeted financial support to families. The success of cash transfer programs during the COVID-19 pandemic has highlighted the potential for such initiatives to provide stability and security for households facing economic shocks. By building on this experience, we can create enduring cash transfer programs that can benefit Americans when the next recession arrives. Families are the essential building blocks of our economy and our country, so our first move should be to help them retain their purchasing power, escape poverty, and improve their household balance sheets, ultimately shortening the duration of a recession.

Decrease in the number of Black kids living in poverty due to the CTC

Decrease in the number of Hispanic kids living in poverty due to the CTC

Automatic stabilizers should be distributed as soon as a recession threatens, with payments that are significant, consistent, reliable, and targeted to those who are most vulnerable to economic instability. The goal is to ensure that the program can effectively support low-income families and individuals most at risk of being adversely impacted by economic contractions.

ChallengeThe urgency of economic crises often leads to expedited decisions and compromises that may not align with long-term policy objectives. By putting automatic stabilizers in place before the next recession, we can overcome the hurdles of a polarized political environment, namely, outlining a plan for payment distribution and determining the optimal size of cash transfers.

There are numerous ways to find the funds to make direct cash payments possible, ranging from increasing taxes, to financing the program through government debt. These are fundamentally political decisions that Congress will have to face in the legislative process.

The logistical challenges of establishing effective and efficient cash distribution frameworks require investments in state capacity, technical frameworks, and staff to ensure that cash distributions happen smoothly.

What We DoOur partners at the Institute on Race, Power and Political Economy advance research to understand structural inequalities and work to identify groundbreaking ways to promote equity. In collaboration with Naomi Zewde, Assistant Professor in Health Policy and Management at the UCLA Fielding School of Public Health, and founding Director of the Institute Darrick Hamilton, ESP co-founder Chris Hughes wrote Direct Cash Payments in the Next Recession. This report crystalizes how elected officials can proactively ensure that American families and the U.S. economy are safeguarded before the next economic downturn.

Our Team

Founder

Vice President of Campaigns and Political Strategy

Senior Director of Campaigns

Legislative Advocate