Guaranteed income is moving from pilots to policy.

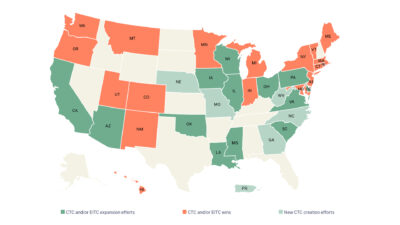

States can lead the way to a federal guaranteed income. Cash tax credits can function as a guaranteed income, laying the groundwork for the future.

States can lead the way to a federal guaranteed income. Cash tax credits can function as a guaranteed income, laying the groundwork for the future.

12. 14. 2023

Visit resource page: Direct Cash Payments in the Next Recession

08. 29. 2023

Visit resource page: An Income Floor For Unhoused Students

12. 19. 2023

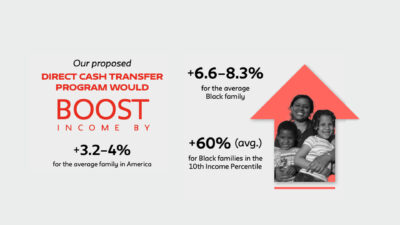

Visit resource page: Momentum Grows for State Tax Credit Programs with Key Legislative WinsCash is a powerful and effective tool that allows families to afford childcare, pursue higher education, and provide necessities – while preserving the freedom to make their own choices. Evidence from several successful guaranteed income pilots and federal cash programs like the expanded Child Tax Credit proves that direct cash programs improve people’s lives. Despite the data, politicians are creating political barriers at the federal level, and have failed to enact the expanded Child Tax Credit which was responsible for cutting child poverty in half. State governments have the opportunity to explore ambitious, publicly-funded cash transfer policies that promote dignity and greatly improve the lives of their residents; add to a growing body of research with assessments of large-scale impacts across geographically and racially diverse areas; and create the model for a permanent federal program.

ChallengeAn exciting number of cities and municipalities across the country are exploring guaranteed income through demonstrations. These demonstrations are providing powerful stories and critical data to inform the broader push for a guaranteed income. We know, however, that to transform people’s lives we need to translate the impact of these time-bound demonstrations into permanent policy shifts. That’s why we’re focused on funneling the power of the pilots into permanent policies at the state and federal levels.

What We DoWe arm state-level advocates and policymakers with information regarding the choice points in program design, the positive impacts shown by existing research, and special considerations for states including options for guaranteed income implementation, interactions with existing public benefits programs, opportunities for public funding, and promoting racial equity.

Our Guaranteed Income Community of Practice provides a space for advocates, policymakers, practitioners, funders, and more to work together to build from pilot to policy.

Produced in collaboration with the Shriver Center on Poverty and Law, our report, “Guaranteed Income: States Lead the Way in Reimagining the Social Safety Net,” is the first in a series of efforts to make this information accessible to state and community leaders who are committed to advancing versions of a guaranteed income in their localities and states.

ImpactIn California, we worked to triple the CalEITC program and establish the Young Child Tax Credit, and expand these credits to ITIN filers. In 2022 we helped eliminate the income requirement for the Young Child Tax Credit (a boon to approximately 100,000 families with zero earnings), protect poverty-reducing tax credits from debt interception, and double state investment in free tax prep.

In Illinois, we have supported $250 million in direct cash relief to Illinoisans–including several guaranteed income pilot programs that serve as models for the nation–providing seed money, advocacy, and communications support. We helped Cook County make history both by implementing the largest publicly funded guaranteed income pilot in the country, and by becoming the first municipality in the US to commit to making their pilot a permanent policy. The program, Cook County Promise, provides more than $45 million for over 3000 Cook County residents, in payments of $500 per month over two years. These payments will provide stability, predictability and an opportunity for recipients to have agency over their own lives.

Our Team

Associate Director, Guaranteed Income