Update

This Map Keeps Expanding

07. 12. 2023

It’s clear that the laboratories of democracy are relentlessly improving the cash formula, and are moving quickly from pilots to policy.

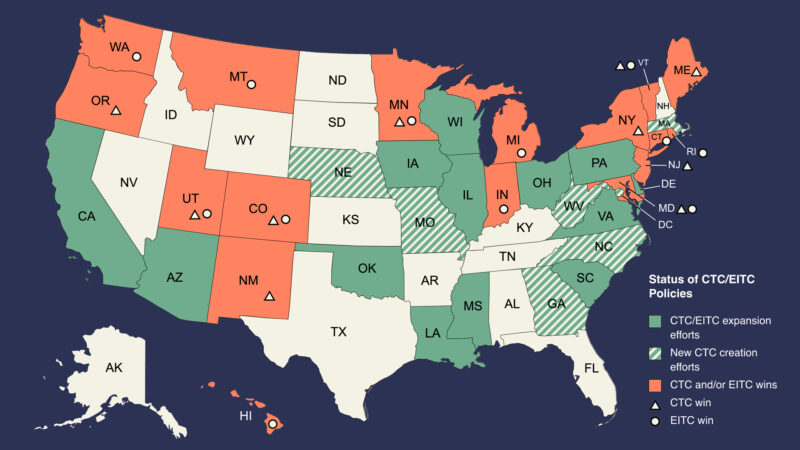

In the most successful year for state tax credit wins in recent memory, seventeen states and counting have expanded or established cash tax credit programs (Child Tax Credits or Earned Income Tax Credits) in 2023. Spurred in part by our Pilots to Policy State Fund, that’s $2 billion in new direct cash to over three million families so far this year.

In just the past few weeks, our state partners in New Jersey, Maine, and Vermont won tax credit campaigns, and Oregon’s legislature established their own Child Tax Credit, modeled after a California policy that we helped design. Fourteen states have now enacted some version of a permanent state-level Child Tax Credit, doubled from seven states in 2021, and with campaigns ongoing in Massachusetts and DC.

States have also enacted key reforms to existing credits, including: eliminating income requirements; allowing ITIN filers to receive the cash; and implementing quarterly payment schedules to help smooth income volatility. It’s clear that the laboratories of democracy are relentlessly improving the cash formula, and are moving quickly from pilots to policy.

To help keep track of all of this progress, we’ve created a fact sheet covering our 2023 wins. Some highlights:

- Minnesota passed the largest CTC of the year, up to $1,750 per child.

- Maine made its CTC fully refundable, so even the lowest-income families qualify for the full credit.

- New York expanded the Empire State Tax Credit to include approximately one million additional kids, with ESP’s efforts on the ground helping ensure that New York families with children aged three or younger receive $330 per kid in extra cash.

- Hawaii doubled the amount of money it will distribute through its EITC program.

- Washington state has broadened its tax credit and made it easier to access.

- Vermont’s Republican governor expanded the CTC and EITC to all immigrant residents, and required the state to set up a system to pay the cash in quarterly installments.

- Red states Montana and Indiana both increased their Earned Income Tax Credit to match 10 percent of the federal credit.

- Then there are the wins from earlier this year – including a new tax credit in Republican-governed Utah, a significant tax credit expansion in Michigan, a tripling of the size of the tax credit in New Mexico, and a broadened CTC and new EITC in Maryland.

- There’s more on the way: seventeen additional states, plus the District of Columbia, recently considered or are considering bills to enhance direct cash payment programs.

With the benefit of this state momentum, we’re continuing the fight at the federal level–we’ve spoken out for the Working Families Tax Relief Act, and rallied 208 members of Congress behind The American Family Act, both of which would reestablish the expanded federal Child Tax Credit. At our urging, our allies in Congress have once again drawn a clear line: no corporate tax breaks without the Child Tax Credit. Colorado Sen. Michael Bennet, a co-sponsor of the Working Families Tax Relief Act, decried an unjust tax system and issued an impassioned call for a permanent, expanded CTC to help end child poverty in America.

We can’t wait to update you on the federal battle, as well as news of new states that have joined the expanding movement to bring cash tax credits to families. In the meantime, check out the Rockefeller Foundation’s blog post explaining how we’ve helped partner with local groups to achieve these wins.