Cash Tax Credits

Claim Your Cash

01. 23. 2024

A Pilot to Connect Families to Tax Credits in Los Angeles County

THE PROBLEM: Los Angeles County families miss out on $500 million in unclaimed tax credits each year. Why? The process of filing taxes is too tricky to navigate alone.

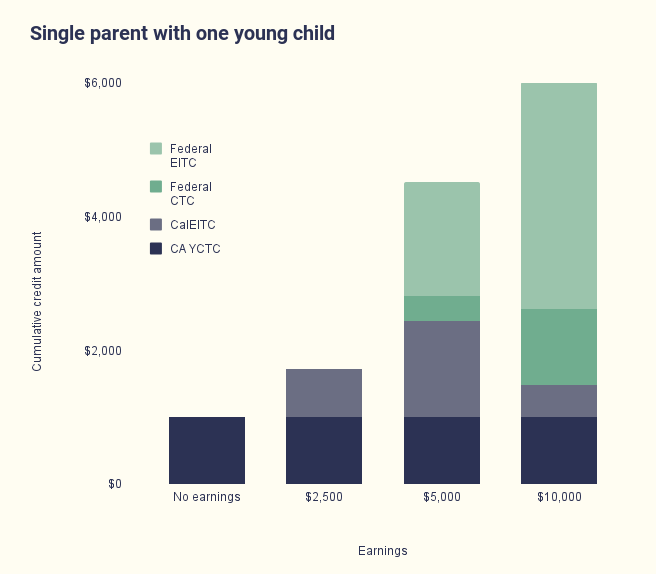

Depending on a family’s income and how many children they have, a family might be able to claim up to $10,000 in both state and federal taxes. Unfortunately, many people who are using county services are not claiming the cash back that they qualify for. And it’s often families with the tightest budgets, who are most likely to miss out.

By design and practice, many of the people who need valuable tax credits have the hardest time getting it. Research in California has revealed that a significant proportion of low-income households, including a disproportionate number of Black, Latinx, and Indigenous, miss out on receiving cash payments through state and federal tax credits and stimulus payments. Many of these families are receiving other government benefits and services, like food stamps, so they are already interacting with county agencies regularly. But they’re not getting everything they qualify for.

One major reason Californians are leaving billions of dollars on the table is that the onus for claiming tax credits, as with other safety net benefits, falls on individuals, who need to perform the right combination of tasks at the right time to unlock them. The act of filing taxes is burdensome, confusing, and full of barriers for low-income families, immigrants, and anyone for whom English is a second language.

The end result of this process is that LA households miss out on over $500 million in these tax credits a year. That’s money that could be going into household budgets and into our local economy. That’s why the Board of Supervisors chose increasing tax credit take-up as one of the top five priorities of its sweeping Poverty Alleviation Initiative.

Designing a Better Way to Do Taxes in Los Angeles County

At Economic Security California (ESCA), we believe there is a better way to administer tax credits that closes equity gaps– and we’re proving it in Los Angeles County. In collaboration with Los Angeles County departments, the CEO’s Office, and other community partners, we are working to connect thousands of eligible low-income families to tax credits via the “Claim Your Cash” Pilot Program (CYCP). CYCP will proactively engage county benefit recipients and facilitate a “warm handoff” to appropriate community-based organizations that provide free income tax preparation through the Volunteer Income Tax Assistance (VITA) program.

This collaboration bridges an existing gap between social services recipients and Federal and State tax credits such as the EITC, FTC, CalEITC, and YCTC which go unclaimed. Here’s how the “warm handoff” works:

- During an already-established appointment or interaction with a government agency (such as DCFS or a home visit with DPH) , staff will engage with the client about tax filing, and ask if the person claimed the CalEITC, YCTC or FYTC.

- If not, the County staff member will direct a phone call at that moment and directly connect the client to a trusted community organization that can provide free tax prep services via our Claim Your Cash Call Center (888-844-3276). Staff will also provide guidance about what information the person needs to get ready before their appointment.

- Once the connection has been made the VITA partner will take it from there to make sure the person files their taxes and claims these valuable credits.

“This is a critical step toward a more fair tax system, where the government, not the individual, is responsible for ensuring access and an accurate return.”

If operated effectively, this program will shift the burden that individuals experience when interacting with the government, which functions as a “time tax” on low-income households.

ESCA’s goal is for the pilot to generate significant, replicable results, both in terms of dollars for new filers, as well as data and insights, such that this model would become a new “standard operating procedure” for Los Angeles County government – and beyond. This project is part of a larger effort to make tax credit delivery automatic in California and across the nation. Put simply, we want taxes to be easier so families can focus on where they are going to spend their refund.

For more information on the Claim Your Cash Pilot Program, please contact:

Mónica V. Lazo, Southern California Program, ESCA at mó[email protected] or visit ClaimYourCashLA.com.