Cash Tax Credits

Polling Shows Strong Support for the Child Tax Credit in 2023

09. 13. 2023

A national survey of 1,421 registered voters say that they'd support a plan to expand and improve the Child Tax Credit

Polling – published by Hart Research Associates in collaboration with Economic Security Project and Groundwork Action, shows broad support for the Child Tax Credit and makes the case for why Congress should prioritize the policy. The poll also makes it clear why any tax deals that include tax breaks for corporations must prioritize tax breaks for working families or candidates could risk losing political favor. Below are three highlights from the poll:

- There is overwhelming agreement (81%) that Congress should not pass corporate tax cuts until they support families.

- Voters are 58% less likely to support someone who opposes the CTC while supporting tax breaks for the wealthy.

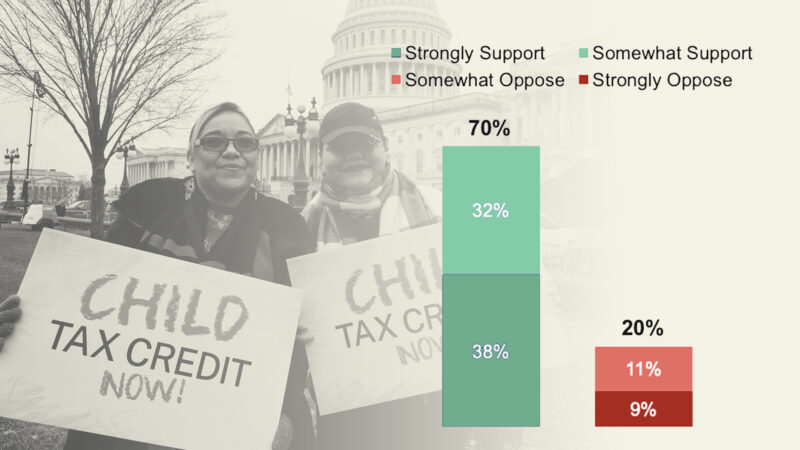

- Support for the expanded CTC remains very strong with 70% of registered voters in support of it and only 20% opposed.

- Voters highly favor (82%) the CTC’s full availability to low- and middle-income families, including 80% of Independents and 77% of Republicans.

You can see the specific points referenced above and more of the polling questions in the slide deck below.