Direct Stimulus Checks

The COVID Recession and the Year of Checks

04. 15. 2021

Evidence from the last year shows stimulus checks to be the fastest and most impactful investments helping Americans get through this crisis.

Download the Presentation

Recovery Americans Can Hold In Their Hands

Visit link (opens in new tab): Recovery Americans Can Hold In Their HandsExecutive Summary

A year ago, the IRS began sending out stimulus checks to households in response to the COVID economic crisis. Since then, Congress has sent Americans nearly $850 billion through three rounds of stimulus checks. This critical relief has played a leading role in helping Americans keep their heads above water during this recession – reducing poverty; helping families cover basic needs; filling in the gaps in other programs, particularly for Black and Latinx households; boosting small business revenue; and increasing state and local revenues.

Cash has been the subject of policy and political conversations to end poverty and forge a new path for economic security for several years, but many politicians clung to traditional notions that aid should only flow through bureaucratic government programs. The pandemic and recession shook up that ossified consensus.

Bolstered by community-driven policy design, state and federal legislative advocacy campaigns, years of rigorous economic study, and building political momentum, this was the year that cash broke through as smart policy and winning politics. Not only have policymakers from state and local leaders to bipartisan members of Congress and both Republican and Democratic presidents embraced cash policies, including passing expansions of the Earned Income Tax Credit (EITC) and Child Tax Credit (CTC), they have been strongly endorsed by leading economists, business leaders, and voters alike.

Evidence from the last year shows stimulus checks to be the fastest and most impactful investments helping Americans get through this crisis, lifting more people out of poverty than any other single policy. Direct payments to households are broad enough to help most people who need it, filling the holes in other aid programs like unemployment insurance, while flexible enough to allow people to solve their own unique challenges. Cash has been the leading force in reducing poverty during one of the deepest recessions in modern history, and is one of the only policies that can narrow persistent imbalances in poverty, income, and wealth between Americans of color and white Americans.

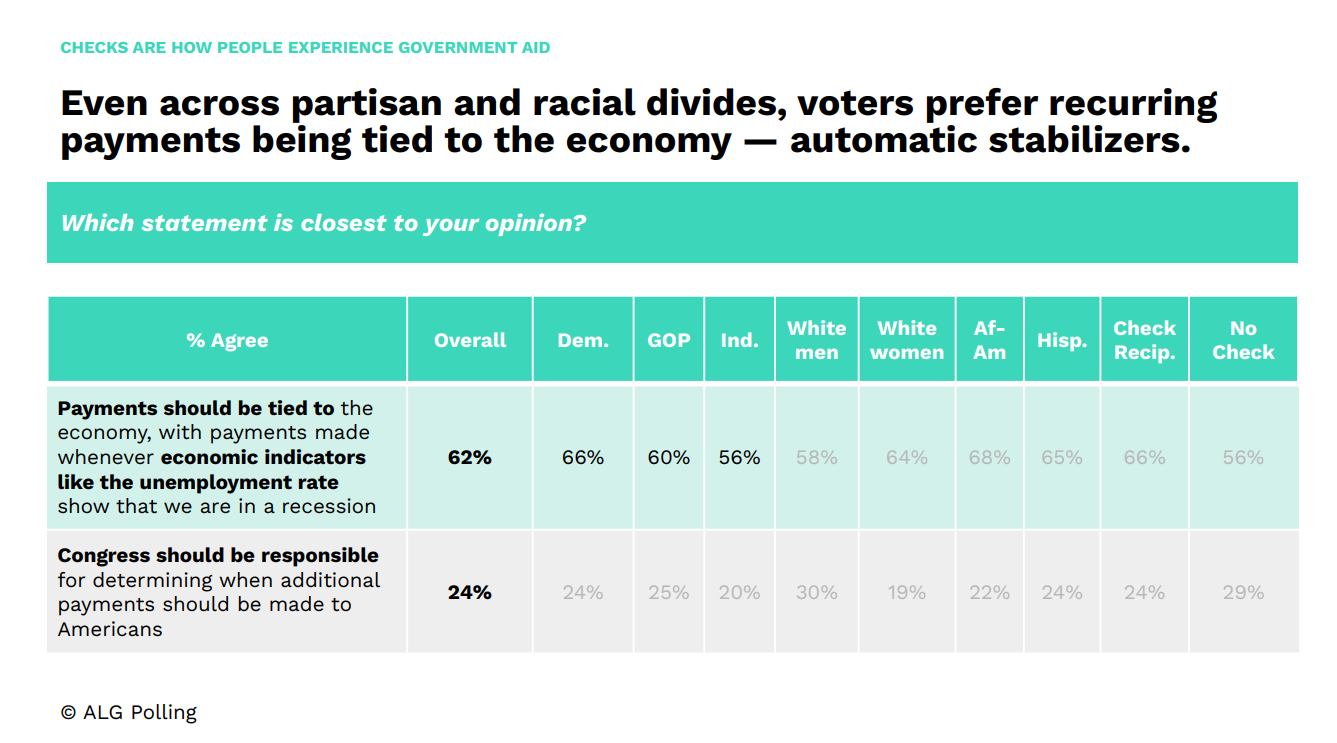

The data make clear that cash has blunted the worst of the recession for millions of Americans. But with low-wage workers and communities of color still facing alarmingly high unemployment and difficulty meeting basic needs, we need to make sure the recovery reaches everyone. That means getting additional checks now to those still struggling and building a lasting foundation of economic security through future stimulus checks tied to economic conditions – automatic stabilizers. It also means making permanent the monthly CTC and EITC expansions. In that way we can ensure a fast, equitable, and full recovery and sustainable economic growth that benefits all Americans.

The Power and Impact of ChecksThe Power and Impact of Checks as COVID Relief

After the passage of the CARES Act in March 2020, the federal government sent relief payments of $1,200 per adult and $500 per child to 160 million American households. In the year since, Congress has authorized two more rounds of direct checks of $600 and $1,400 – totalling close to $850 billion in direct payments into people’s bank accounts.

$850 billion in direct cash to American households over the past year

- Three rounds of checks – $1,200, $600, and $1,400

- A 20% income boost for the lowest-income households

- More than $5,500 per household on average

- $250 billion to people of color

- $480 billion to households in the bottom 60% of incomes

1. A smart and effective investment. A year of research on the stimulus checks shows that cash is one of the best policy interventions available in a crisis. Cash gets the most help to the most people who need it, stimulating the economy and shortening the recession. Direct payments:

- Boost consumer spending. Stimulus checks induce spending at all income levels, most sharply among low-income people, increasing aggregate demand and stimulating local economies.

- Increase small business revenue, especially in rural communities.

- Increase state and local revenue. Cash payments increase Americans’ incomes, boosting their spending and the tax revenue that consumer activity generates. That buoys state revenues, and has given state budget writers facing shortfalls some reason for optimism.

2. A powerful poverty reducer. Cash has been the leading poverty fighter throughout the recession.

- The primary reason poverty fell at the start of the recession. Data indicate that a round of $1,200 checks lasted most families about 2-3 months. As aid ran out in the summer and Americans were left hanging into the fall, up to 8 million people were forced back into poverty.

- The driving force behind the American Rescue Plan (ARP), which is projected to cut child poverty in half this year, due mostly to investments in direct cash payments and the new income floor for families with kids. Of the 16 million people the relief package will keep from poverty, the $1,400 checks will alone keep 11 million people out of poverty this year, compared to less than 4 million for the unemployment insurance expansion in the bill.

- A tool to eliminate poverty altogether. A fourth and fifth check could keep an additional 12 million out of poverty. Combined with the effects of the ARP, direct payments could reduce the number in poverty in 2021 from 44 million to 16 million.

3. A winning political motivator. Direct cash payments have received bipartisan support as lawmakers have negotiated COVID relief over the past year. Cash has been championed both by the former Republican president and President Biden, as well as members of Congress from both sides of the aisle. In the pivotal Georgia Senate election, direct checks were a deciding factor for many voters in the last days of the campaign, and were a contributing factor to delivering the Senate majority for Democrats.

This was the year that cash broke through as smart policy and winning politics.

The data: how Americans have used checks during the crisis

1. Cash is a simple solution that meets Americans where they are. Every person has faced unique challenges related to the pandemic, so no single policy solution can deliver the help that everybody needs. But the data are clear: money gave people the flexibility to determine what they needed and how best to use it, and they spent their checks accordingly.

- Families who receive stimulus payments spend them overwhelmingly on necessities like food, household expenses, rent or mortgage payments, utility bills, or debt payments like credit cards, student loans, or car payments. Others spend in ways that help them preserve employment income, like fixing a car needed to get to work

- Cash provides relief to the millions of people left out of other aid programs like unemployment insurance and PPP. Only 36% of households earning under $50,000 who have lost job income have received any unemployment benefits. Another recent study found that only 41% of the unemployed had received benefits, and confirmed previous research that workers of color, especially Black workers, are substantially less likely to receive benefits compared to others. Similarly, difficulties in administering the Paycheck Protection Program (PPP) left many small business owners and employees reliant on stimulus checks to stay afloat.

Experiences from across the U.S.

“I’m still not working. I don’t qualify for unemployment and my husband and I only live on his Social Security. We can make our mortgage, but not the utilities or food. The stimulus helps us pay our medical insurance and my insulin. A stimulus every month would help us greatly.

– Debra, Illinois

“The stimulus and child tax credit will make sure our family can stay afloat in these tough times while not going into debt.”

– Mike, Wisconsin

“I lost my customer service job in May of 2020 and have been trying to make ends meet with unemployment and sporadic minimum wage jobs since then. This stimulus [check]bill will give me an immediate measure of stability and dignity as well as confidence in an economy that’ll roar to life for working class folks like me in just a few short months.”

– Vincent, Maryland

2. Low-income people need money and spend it more quickly than high-income households. The research is consistent that lower-income people spend their stimulus checks quickly and on essentials.

- Low-income households are more likely to spend their stimulus money, while higher-income households are more likely to save it. Following the $1,200 CARES Act checks, 8 in 10 households earning under $50,000 mostly spent their checks, compared to a little over half of households earning more than $100,000. Following the $600 checks in January, high-income households were almost twice as likely to save their checks compared to low-income households.

- Checks help families with kids afford food immediately after receiving the money. After most of the $600 checks were delivered in early January, low-income families and Black and Latinx families with kids saw a slight drop in food insecurity over the preceding week. The most recent checks produced a similar drop: between the weeks before the checks went out to the weeks after, the share of families earning less than $50,000 who didn’t have enough to eat dropped from 27% to 21%. For Black and Latinx families, it dropped from 20% and 19%, respectively, to 15%.

- Checks help low-income families make the rent. Before the $600 checks were delivered in January, 19% of families earning under $50,000 had no confidence in their ability to pay the next month’s rent. That share has declined steadily since families received the $600 checks in January, and the most recent checks reduced that share even further to 12%.

Proof of Concept: the Stockton Economic Empowerment Demonstration (SEED)

In Stockton, CA, 125 residents were given $500/month for 24 months. Researchers found that a monthly cash boost helped with:

- Cash flow, reducing month-to-month fluctuations in income and making it easier to meet unexpected expenses;

- Good jobs, helping recipients find more and better full-time work (contrary to fears that cash supports might make people work less);

- Health and wellbeing, making recipients healthier, less depressed, and less anxious; and

- Quality of life and dignity, creating more opportunities for self-determination, choice, goal-setting, and risk-taking.

3. Direct cash paid on a regular basis can help Americans avoid high-interest debt like credit cards and payday loans. As the pandemic has gone on, the number of people using checks to pay off debt instead of spending them on meeting basic needs has shot up – especially among low-income people. This likely demonstrates that these families are taking on credit card and other risky debt in order to meet basic needs in between the relief payments.

- Early in the pandemic, most spent their checks on essentials. When the first round of $1,200 CARES Act checks were sent in April 2020, 70% of families mostly spent their checks, and only 14% used them to pay down debt – mostly higher-income households who used the money to pay down credit cards, student loans, or other debt.

- As the crisis lengthened, people were forced into debt to meet basic needs when checks ran out. After the $600 checks went out in January, only about 22% of families said they mostly spent them; another 26% mostly saved them; and more than half of families across the income spectrum used their checks to pay off debt. Low-income families were significantly more likely to use the money to pay off debt (60% of families earning under $50,000 vs. 40% of those earning $100,000 or more).

- With this latest round of checks, the trend from January continues. Across the income spectrum, half of recipients used it to pay off debt. But lower-income families were more likely to pay down debt, while higher-income families were more likely to save their checks. Among families earning under $50,000, 56% mostly used the check to pay down debt, 26% mostly saved it, and 18% mostly spent it. Among families earning over $100,000, 38% mostly paid down debt, 39% mostly saved it, and 23% mostly spent it.

A Critical Tool for a Race-Equitable Recovery

By almost any measure, Black, Latinx, and Native Americans have been the hardest by this recession. The only way to avoid the mistakes made during the Great Recession and drive a real recovery that reaches everyone is to ensure that a person’s race or ethnicity doesn’t determine their chance at getting back on their feet. Cash is one of the only relief policies that has the potential to narrow the imbalances in poverty and income that decades of systemic racism have created.

- Black and Latinx households are experiencing more hardship compared to others, including higher levels of food insecurity, COVID-related mortality, and business closures.

- Unemployment has remained stubbornly high for workers of color, especially Black workers. While the overall unemployment rate has now dropped to 6%, Black unemployment is still higher than any other racial or ethnic group at 9.6%. White unemployment has dropped to 5.4% – lower than Black unemployment was before the pandemic.

- During the pandemic, people of color have consistently had a harder time meeting basic expenses compared to white people. Two-thirds of Black and Latinx households had difficulty meeting basic expenses in the past week, compared to fewer than half of white households.

- Checks, especially targeted to those who need them most, have outsized impacts in communities of color. According to analysis by ITEP, a round of checks tailored to reach families earning under $100,000 would:

- Cover 75% of Black and Latinx families;

- Give Black and Latinx families about double the income boost as white families, helping close the racial income gap; and

- Dedicate 41% of total benefits to families of color, who make up 33% of tax filers.

- Other cash supports, like transforming the CTC into an income floor for families with children, disproportionately benefit Black and Latinx children, who were most negatively affected by the previous exclusion of very low-income families.

Other Cash Supports Will Build on the Success of Checks

In addition to direct stimulus checks, over the last year Congress has authorized historic expansions of successful existing cash policies. Through the American Rescue Plan, Congress expanded the Child Tax Credit and made it monthly, creating an income floor for caregivers and families with kids. And it strengthened the Earned Income Tax Credit, extending to workers age 19 and up and tripling the size of the credit for workers not raising children at home. But these expansions are only temporary and should be made permanent. These cash supports, like direct checks, are incredibly powerful tools that target those who need the most help and provide the kind of support that everybody can put to good use.

Continued ReliefTo Ensure a Full Recovery That Reaches Everyone, We Need to Continue Cash Relief

This has been called the most unequal recession in history. Low-income workers, disproportionately Black and Latinx, have lost more jobs and income, and their jobs have been slower to return. Millions of jobs haven’t come back at all, and one in four unemployed workers has now been out of a job for more than a year.

- During the pandemic, low-income people have consistently had a harder time meeting regular expenses than higher-income people and white people. Even as unemployment is falling and many policymakers are expressing optimism that the broader economy is out of the woods, nearly 3 in 4 households earning under $50,000 had difficulty meeting basic expenses in the past week, compared to 27% of households earning $100,000 or more.

- Low-income workers are still experiencing historically high levels of unemployment. Workers who had been in the bottom 25% of earners faced an unemployment rate of around 22% in February, compared with the overall rate of 6.2%, according to a recent speech by Federal Reserve Governor Lael Brainard.

- Recent polling suggests the $1,400 checks will only last people a few months. When asked how long a $1,400 check would last them, one in four said only a week or two, and nearly 60% said it would last them three months or less. Three in ten Black respondents said the check would only last them a week or two.

Cash has been a lifeline for Americans during this crisis, and will continue to be as long as the crisis continues. But the work ahead is ensuring that the most unequal recession in modern history isn’t followed by the most unequal recovery. Going forward, policymakers must prioritize policies that reach everyone who needs help – especially the low-income households and households of color who the data show are still struggling to get back to baseline. And the relief and stimulus must continue until the recovery reaches every community in every part of the country. After one year of and three rounds of direct payments, the research shows that cash gets the most help to the most people who need it, stimulating the economy and shortening the recession. Future relief must include:

- More direct payments, targeted at those who need help most – that continue on a regular basis until economic conditions show that everybody is back on their feet, an idea that has been championed by 21 U.S. Senators.

- Permanent expansions of the monthly Child Tax Credit and Earned Income Tax Credit – policies that were never built to be emergency measures, but which can ensure that those living in financial precarity are on stronger footing both in crisis and normal times. 41 U.S. Senators support making these improvements permanent.

Improvements to implementation of cash policies to make sure that everyone who is eligible for a stimulus check, CTC, or EITC receives it automatically.